Business valuation has long been seen as a tool reserved for exit planning. It’s often associated with the final stages of a business’s lifecycle, used to determine a company’s value for sale or handover. But viewing valuation solely through the lens of an endgame strategy is a missed opportunity.

Business valuation offers powerful insights that can guide privately held business owners to manage more strategically through every phase of their business’s lifecycle.

Rethinking Business Valuation

Reserving business valuation only for exit strategies overlooks the broader strategic advantages of understanding the financial worth of your business.

Whether you’re in the early days of growth, navigating the challenges of scaling, or planning for succession, valuation can serve as a versatile decision-making tool.

Think of business valuation as more than a number—it’s a snapshot of your business’s financial health, market standing, and areas of potential. From refining your growth strategy to preparing to raise capital, the insights gained from a valuation can be pivotal to guide decisions at every step.

How Business Valuation Guides Decisions at Every Stage

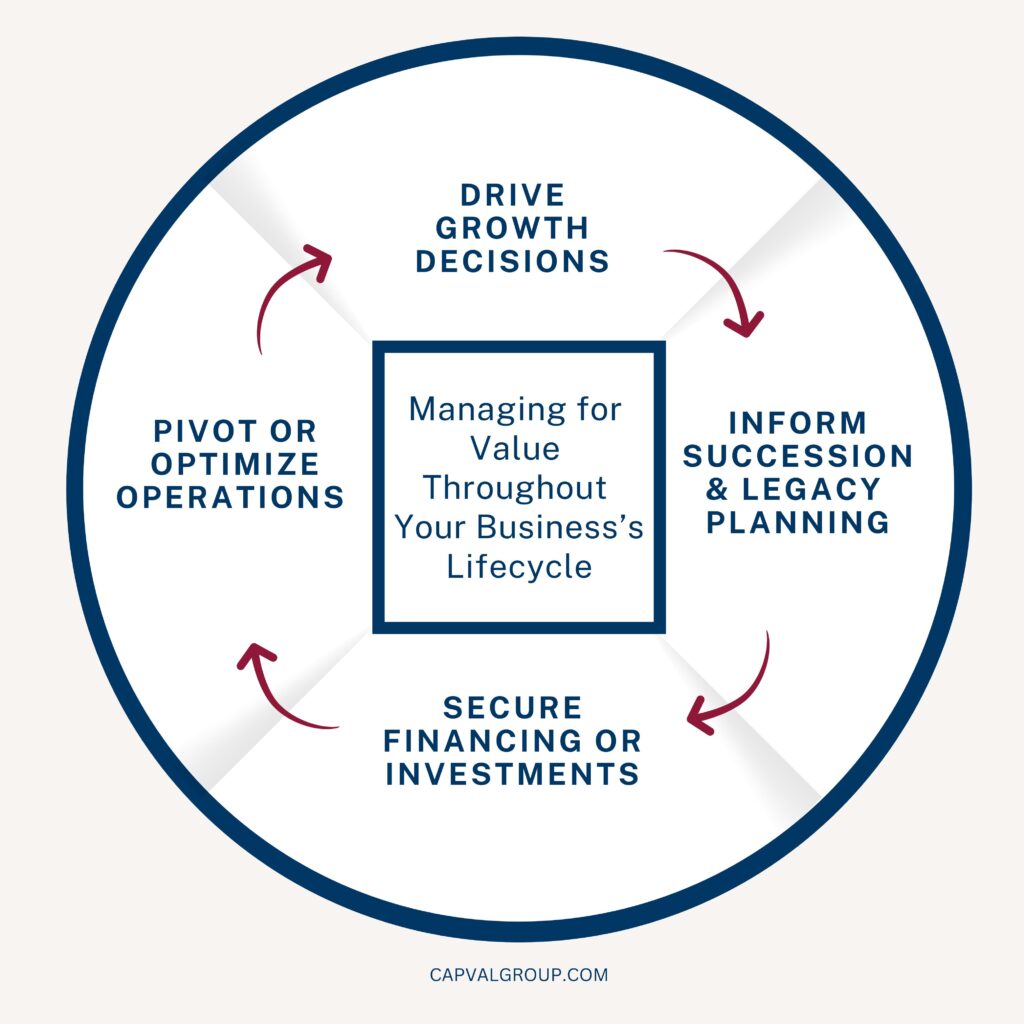

Periodic business valuations are essential to managing your business as an investment. Here’s how our business valuation process can add value at different stages of your business’s lifecycle:

1. Informing Growth Strategies

Understanding where your value lies can help you make informed decisions on where to focus your time and resources. For instance, valuation insights might highlight opportunities to enhance efficiency, boost profitability, or expand into new markets.

For example, a mid-sized manufacturing company used annual valuations to identify which of its product lines carried the most profit potential. The business invested in streamlining operations for that line and phased out less profitable products, leading to a 30% increase in revenue over three years.

2. Succession and Legacy Planning

Business owners often leave succession planning until too late. Regular business valuations can make these conversations easier by providing an objective assessment of your company’s worth. Knowing your value equips you to negotiate terms with potential successors, whether they’re family members, employees, or outside buyers.

3. Securing Financing or Investments

A solid valuation is often a prerequisite for securing business loans or attracting investors. Financial institutions and investors will want concrete evidence of your company’s worth before committing resources. Business valuation reports bolster your credibility and provide a clear picture of your financial standing.

4. Pivoting or Optimizing Operations

Markets change. Customer needs evolve. A business valuation with Capital Valuation Group can highlight areas where you may be overinvesting or overlooking opportunities. It gives you the information to pivot or optimize your operations for better performance.

Real-World Insights in Action

Consider a regional engineering firm that used its annual business valuations to streamline and standardize the process of bringing in new owners. By having a clear and consistent valuation framework, the firm ensured smoother transitions, minimized disruptions, and maintained stability during ownership changes.

Another business, a family-run financial services company, used regular valuations to transition ownership between generations. By beginning the valuation process early, they ensured a seamless handover and preserved the company’s legacy. They also achieved key estate planning objectives, securing the financial future of the family.

Beyond the Numbers

Business valuation is more than a financial statement—it’s a strategic tool that empowers business owners to make informed decisions.

Whether you’re refining your growth strategy, preparing for succession, or exploring market opportunities, the insights you gain from periodic valuations can help you not only manage your business as an investment, but also give you a critical edge over competitors.

For advisors, encouraging clients to view valuation as part of an ongoing strategic process rather than a one-time event can demonstrate your commitment to their success and reinforce your value as a trusted partner.

Final Thoughts

The true value of a business lies not just in its assets or cash flow but in the opportunities those numbers unlock. Periodic business valuations throughout a business’s lifecycle provide the clarity and foresight needed to capitalize on those opportunities, ensuring your business grows, thrives, and stands the test of time.

If you’re ready to redefine how you view your company’s value, start thinking of valuation as a tool for growth, not just succession. Reach out to us today and take control of your business's future.