Different potential buyers of a business will arrive at very different values. Why? Because buyers have different interests, motivations, knowledge, and plans for what they might do if they become the owner.

Generally, informed buyers calculate the value of a business with a focus on two key levers:

1. Future Expected Cash Flows: The income, after needed reinvestment, the business is projected to generate.

2. Risk Assessment: The likelihood, or risk, of those cash flows materializing as planned.

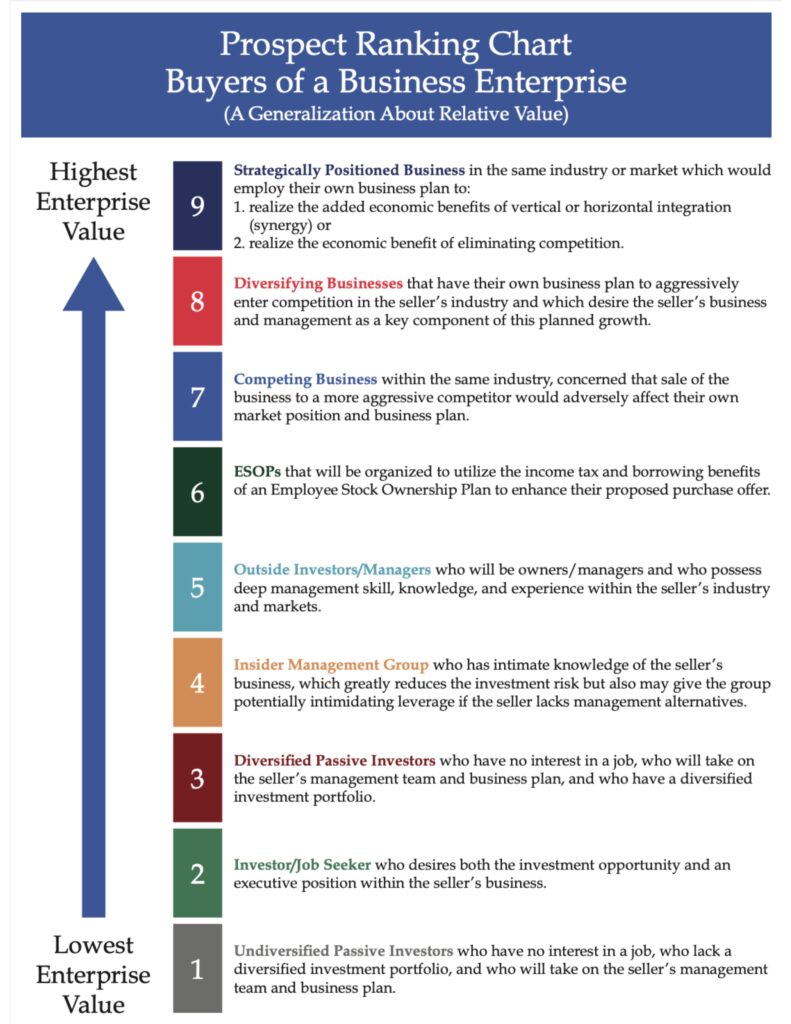

Interested buyers look at, and can quantify, these levers very differently. To assist business owners in identifying and understanding who the different buyers might be, our team at Capital Valuation Group developed the Buyer’s Chart (shown below). This tool helps owners identify the characteristics of different buyers and understand why one buyer might value the same business differently than another.

The Buyer’s Chart Explained

The Buyer’s Chart ranks different types of buyers based on the value they are likely to offer for the business, starting with those willing to pay the least (at the bottom) to those willing to pay the most (at the top).

Buyer Types 1-3: The Passive Investors

These buyers do not participate in the daily operations of the business. They seek a passive investment, relying on the current management to continue executing the business plan. Their primary motivation is to diversify their investment portfolio, and they believe the business can offer a better return compared to other options. However, since they do not control operations, the investment carries higher risk, which translates to a lower valuation.

Buyer Types 4-6: The Insider Buyers

These buyers are actively involved in the business and have a deep understanding of its mission, vision, and daily operations. Their insider knowledge significantly reduces the risk of continuing future cash flows. As a result, they have the potential to both increase those cash flows and manage risk more effectively, leading to a higher valuation compared to passive investors.

Buyer Types 7-9: The Strategic Buyers

These buyers are typically from the same industry and are focused on leveraging synergies to enhance business value. They might see opportunities to expand geographically, increase margins, gain efficiencies, or add complementary business units. For these reasons, strategic buyers are often willing to pay a premium because they can quickly increase cash flows and manage risk effectively, viewing the acquisition as a key part of their broader business strategy.

Strategic Insights

Understanding the different types of buyers and their motivations is a strategic advantage. This knowledge allows an owner to weigh the pros and cons of each buyer type and tailor their exit strategy to attract the best buyer for them to maximize the value of their business and align with other personal goals such as plans for employees and their legacy.

This approach ensures that the seller can not only maximize the sale price of the business (if that is what is most important), but also enables the seller to align with a buyer whose goals and expectations match theirs.

Are you considering selling your business and want to talk through how these buyer types apply to your situation? Contact us for a confidential complimentary discussion. Every business is unique, and we’ve seen a lot of businesses in our 50 years!