The risk of rushing to democratize business valuation

The importance of business owners understanding the value of their business cannot be understated. Far too many business owners believe that a business valuation is not needed unless selling is imminent.

This thinking stunts the owner’s ability to manage their business as an investment—to know with certainty that their decisions and efforts are leading to a more valuable asset over time. Not only is the business likely the largest asset owned, it is also what is going to fund the owner’s retirement.

Just as publicly traded portfolio managers pay attention to the value of each of the businesses in the mutual fund or portfolio, privately owned business owners need to manage their company’s value throughout each of the years of existence.

Whether because of a lack of time or not taking an investment mindset, the privately held business owner tends to think of their business as their job, not necessarily as their investment…until it is time to sell. However, at this point in the game, the owner has forfeited the opportunity to pull the levers that can increase value.

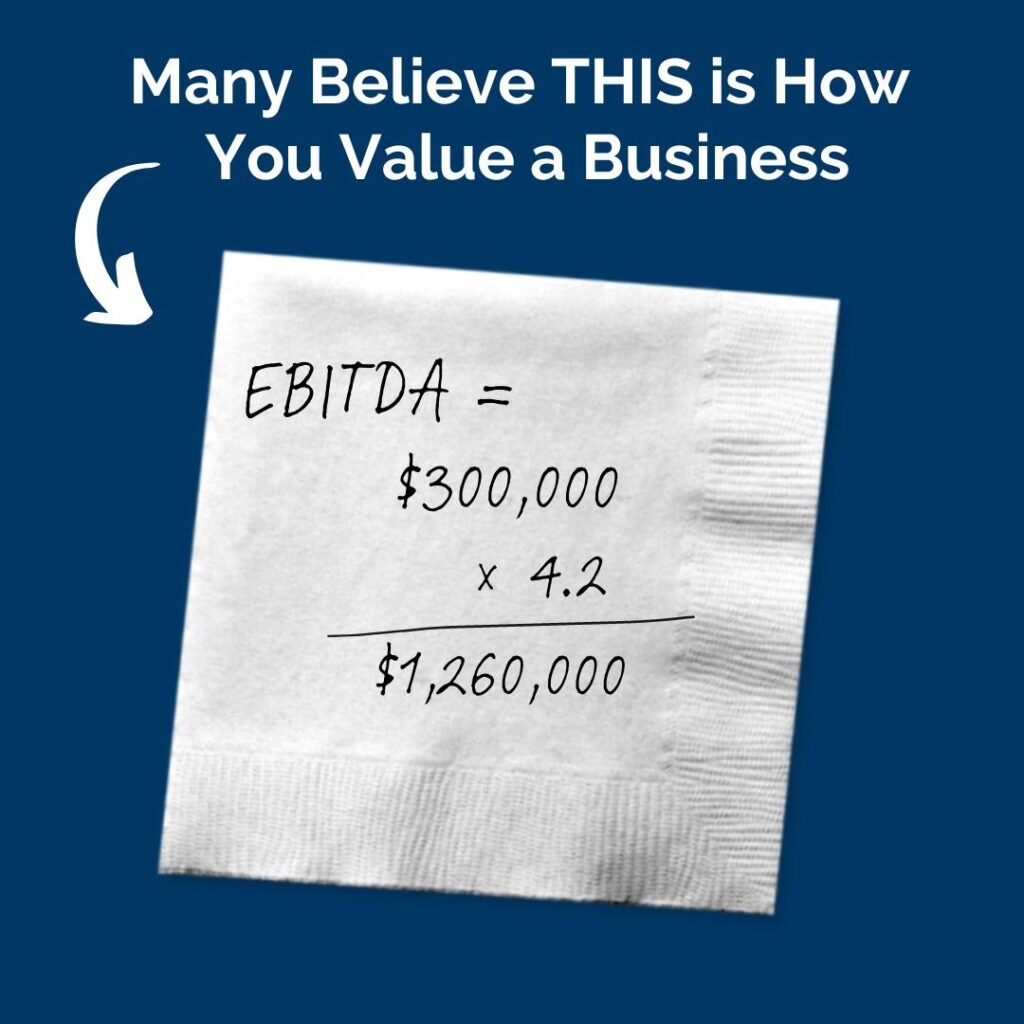

In lieu of the planning and analysis that’s needed, it’s natural to want a quick and easy shortcut to get to what the value of the business might be. The desire to be able to value a complex privately owned business as you would a public company using a multiple in a simple mathematical equation (# x EBITDA, etc.) is never ending. The unfortunate thing is that the answer provided through applying a multiple or an industry rule of thumb is ultimately unsupportable—because it lacks important analysis. No two privately owned businesses – even in the same industry – are the same. And if an actual transaction is based on such math, one of the parties (buyer or seller) is very likely to lose.

One business valuation tool touts its ability to “democratize business valuation.” The site also claims they’ve valued more than 33 million businesses using “big data enabled business valuation services.” This valuation tool works by gathering actual transaction data for businesses (i.e., what did a given business sell for as a multiple of sales/revenue, or earnings, or assets) and then applying these multiples, from the same industry, to the subject company being “valued.” If you are selling a house and have such market data it is very useful because it IS highly comparable data. But a business is not a house, nor should it be valued as such. While the idea of making business valuation accessible to more business owners is a worthy goal, what are you really getting out of the conclusion if the number is not reliable and explainable? We caution business owners to consider what is really happening in these ‘33 million valuations’ or other such use of multiples.

Applying this ‘big data’ to a subject business for purposes of valuation incorporates two critical assumptions:

- 1. That all businesses in the same industry (NAICS or SIC code) are identical.

2. That the "big data" captures the "value" of the business that was sold.

Let’s unwrap these two assumptions.

Without a doubt, publicly traded businesses within the same industry are far more similar to each other than privately owned businesses. The owner of a private business has the ability to determine the direction of the company, considering both quantitative and qualitative factors that a multiple cannot account for. Just consider a few: Will they have stodgy, tired equipment or do they re-invest regularly in updating equipment? Do they have one location or more than one? Are they sophisticated digital marketers or don’t even have a viable website? What level of debt are they comfortable with? What level of management depth does the company have? How dependent is the company’s success on the owner?

The list of these qualitative factors is extensive, but the key takeaway is that every closely held business is unique because it reflects the owner’s management style, risk appetite, and all the day-to-day decisions that have been made and will be made. A business valuation must consider ALL the qualitative factors, not just the quantitative calculation of one number times another number.

In business transactions, the final deal is what is captured in the “big data”—far more appropriately labeled price, not value. Value is where transaction discussions begin, then negotiations occur. The result, or ultimate price agreed upon, incorporates all the terms agreed to in the transaction and reflects the motivations of buyer and seller. These transaction terms make every transaction unique and without considering each of them, an appraiser cannot determine if the transactions being used to obtain multiples are actually comparable to the subject company being valued. Price is different than value, in fact, quite different in the world of private business transactions.

Not unlike saying “it’s simple, you value a business by taking the company phone number, subtract your grandmother’s house number and multiplying by 5” you get an answer, but what does the answer really mean? Too often, it is meaningless. While we fully support having business valuation tools for every business owner to access, we always want to make sure the numbers we are talking about will help them achieve their specific goals, not just put a number on a piece of paper and hope it will be “right” when it comes time to sell or make other important business and life decisions. Having a supportable valuation enables business owners to understand, increase, and unlock the value of their business over the years of ownership.

If you have any questions about the business valuation process or the range of options available at CapVal, we welcome you to schedule a complimentary 1:1 session.

If you would like to discuss a specific business situation please reach out to us through the Contact page or call us at 608-257-2757 and we’ll connect you to a business valuation expert on our team.