For business owners, understanding how business valuation works is crucial for long-term success. When you’re investing in your company, you’re typically aiming for growth, expansion, or increased efficiency—but did you know that these investments can actually decrease your business’s value in the short term? This phenomenon might seem counterintuitive to many business owners, but itRead More…

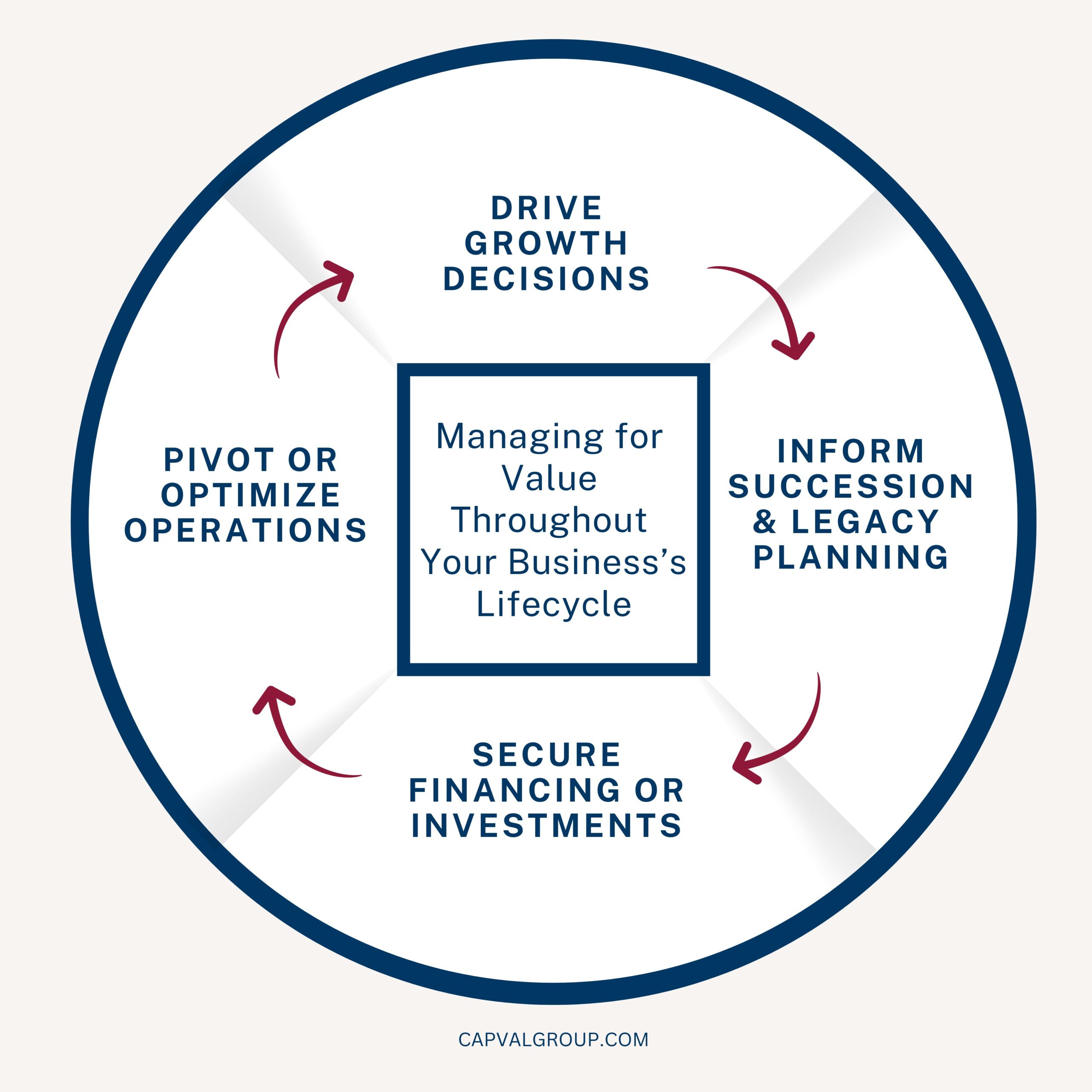

Beyond the Exit Strategy: Managing for Value Throughout a Business’s Lifecycle

Business valuation has long been seen as a tool reserved for exit planning. It’s often associated with the final stages of a business’s lifecycle, used to determine a company’s value for sale or handover. But viewing valuation solely through the lens of an endgame strategy is a missed opportunity. Business valuation offers powerful insights thatRead More…

Business Valuation: The Magic Number

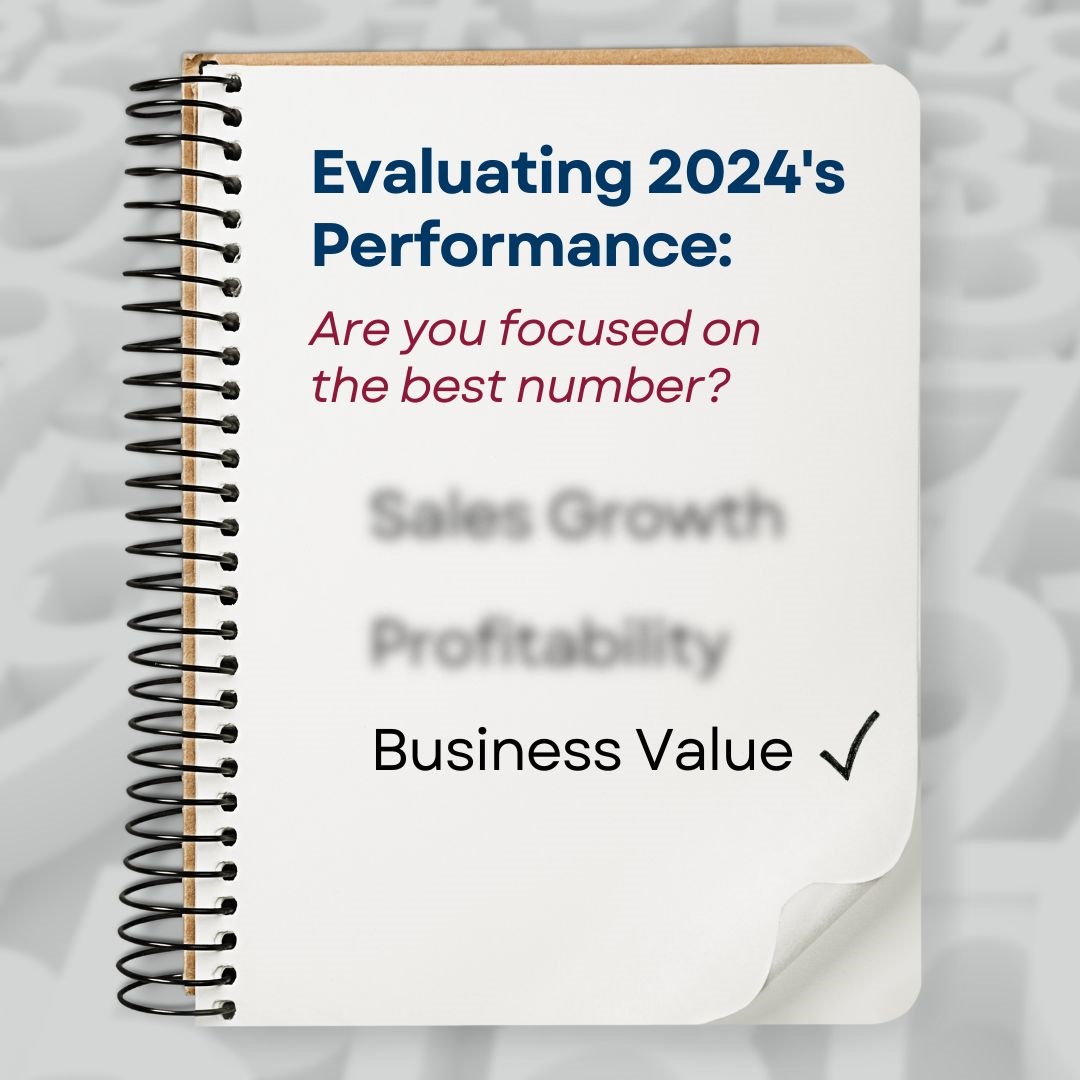

How did 2024 go? The one number that tells the whole story While these metrics are indicators of past performance, they don’t provide a full picture of the business’s overall health. For example: Even profitability can mask underlying issues. Is the owner neglecting needed reinvestments in technology, equipment, or facilities? Is high employee turnover tiedRead More…

Celebrating 50 Years of Business Valuation

A good time was had by all at Nakoma Golf Club on November 14th to celebrate CapVal’s 50th anniversary. We had a great turnout – a big thanks to the nearly 100 people who came to celebrate and to the many others who sent such kind messages. Our President, Jane Tereba, shared the milestones inRead More…

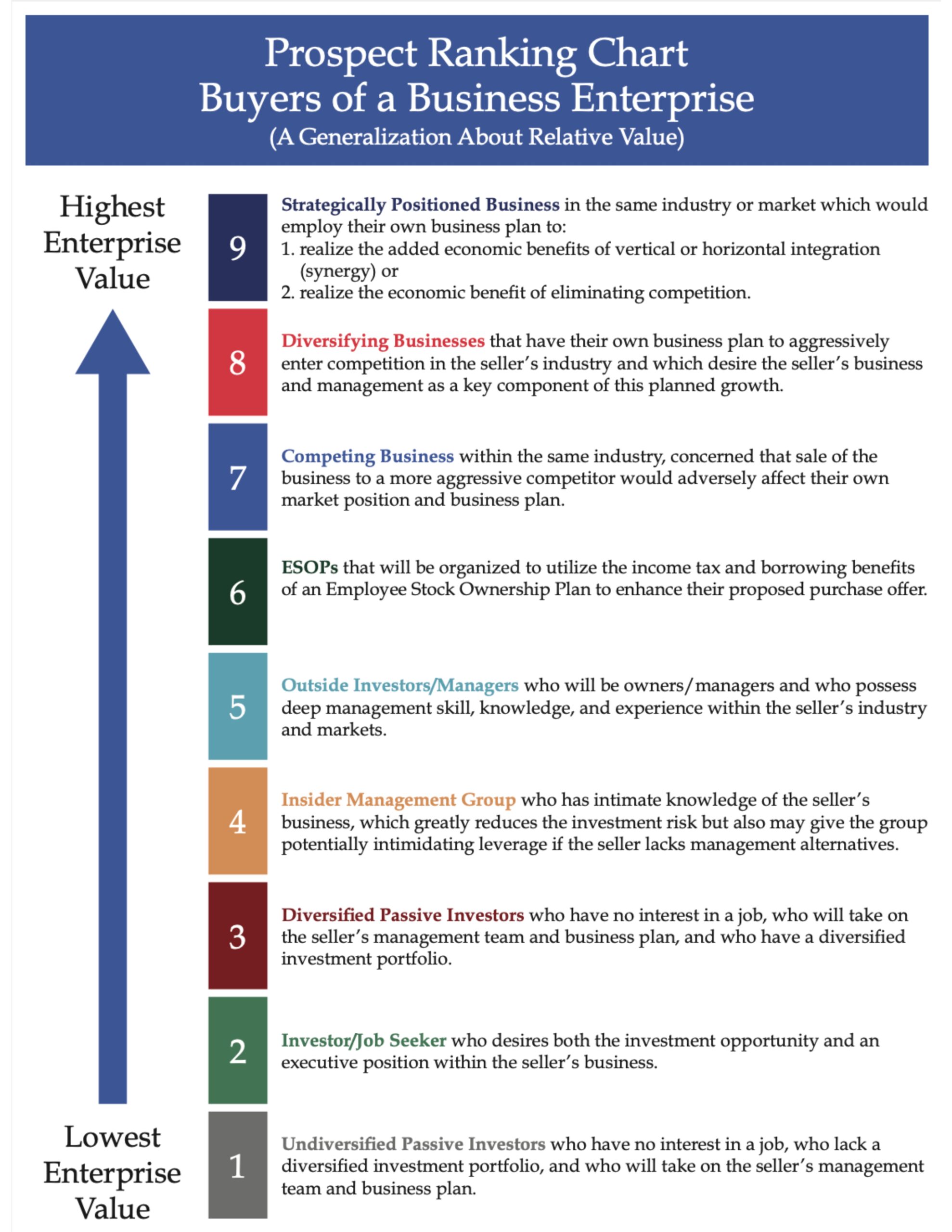

Business Exit Strategy: Which Type of Buyer is Right for You?

Different potential buyers of a business will arrive at very different values. Why? Because buyers have different interests, motivations, knowledge, and plans for what they might do if they become the owner. Generally, informed buyers calculate the value of a business with a focus on two key levers: 1. Future Expected Cash Flows: The income,Read More…

Prevent Lost Opportunity: Know the Value of Your Business

It’s often said that a business is worth whatever someone is willing to pay for it, so why should a business owner bother with a formal valuation, especially if they have no immediate plans to sell? After 50 years of valuing closely held businesses and assisting owners in preparing for ownership transitions, we’ve found thatRead More…

How to Build Value Today for a Future Exit

What if sales growth isn’t the whole story? Business owners begin by selling something—a product, a service, or adding value to existing products or services. As the business takes root and grows, it transforms from a mere idea and typically employment for the owner, into a significant investment, likely becoming the owner’s largest asset. InRead More…

We Started Valuing Businesses Before Valuing Businesses Was Cool

We’re Celebrating 50 Years!

Look What’s Changed in 50 Years…

What surprises you most?

Discounts for Lack of Marketability—What are they and why are they needed?

Experienced business appraisers consider various factors when valuing a privately owned business, one of which is known as the discount for lack of marketability (DLOM). This discount for lack of marketability represents a deduction from the value of an ownership interest to reflect the limited marketability, or ease of sale, of a privately owned business.Read More…

How Has the General Economy Affected Business Value?

There are many day-to-day decisions that we as business owners control and can adjust for; however, one significant issue that is completely out of our control is the general economy. It’s interesting to reflect back over the past two years of business valuations our firm has completed and consider how the more recent economic changesRead More…