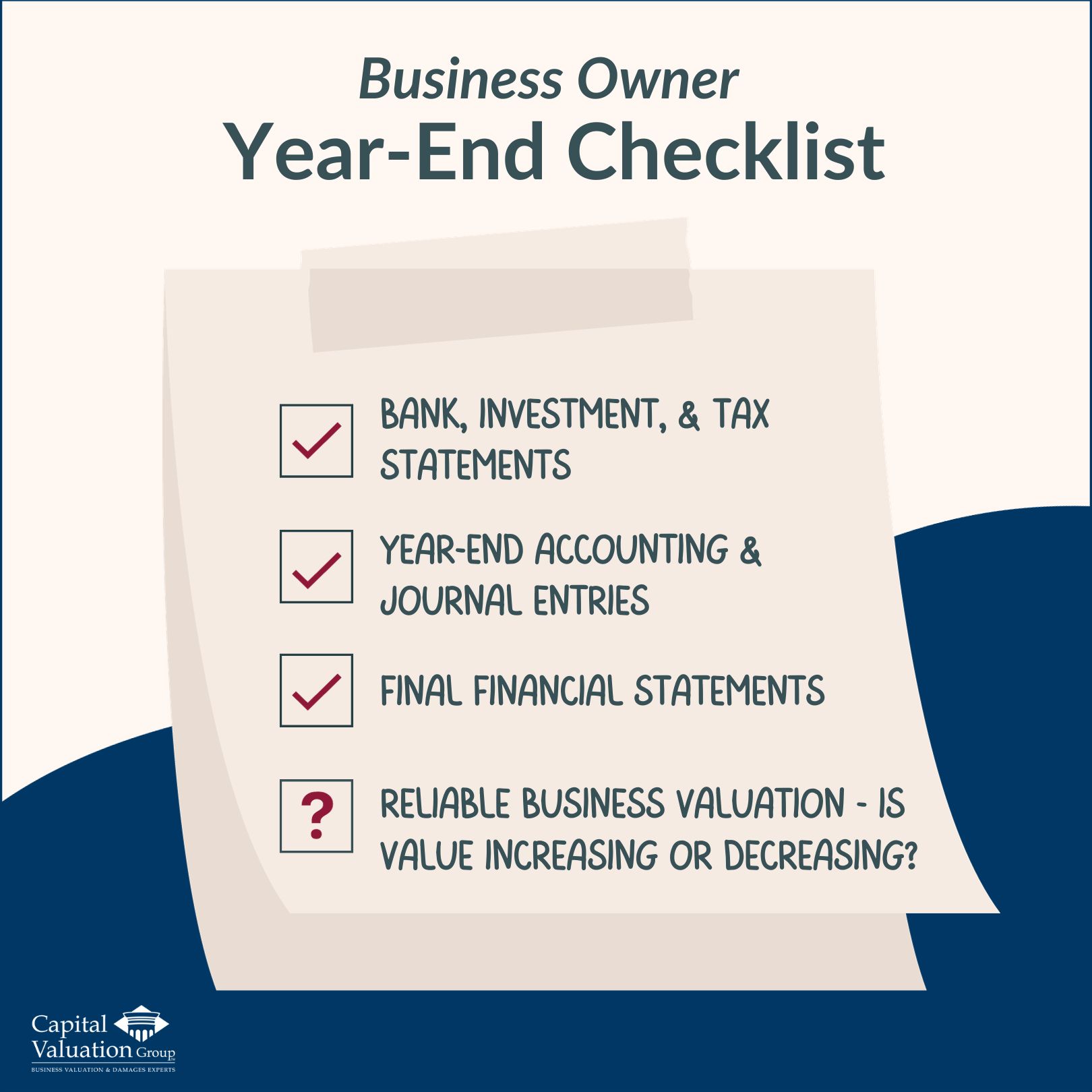

And another year is in the books! It’s time to gather and review our bank statements, investment statements, tax statements…and if a business is owned, wrap up year-end accounting and journal entries to finalize financial statements. But some business owners are missing one critical year-end statement that can be a competitive differentiator…a reliable business valuation.Read More…

Meaningful Business Valuation THRIVES on Complexity and Detail!

A business advisor recently mentioned that they were speaking with a business owner who wanted to plan for the future. The advisor suggested that it would be wise to have a formal business valuation done so that informed decisions could be made in the planning process. The owner responded that their business couldn’t be valuedRead More…

What’s Next? Defining Life After Transitioning Out of Business Ownership

Often when business owners think about transitioning out of business ownership, they focus on numbers and logistics first but don’t always consider what they will do after transitioning out of ownership. We’re talking about the big ‘what’s next?’ question that almost all of us face at some point in our careers, and the reaction businessRead More…

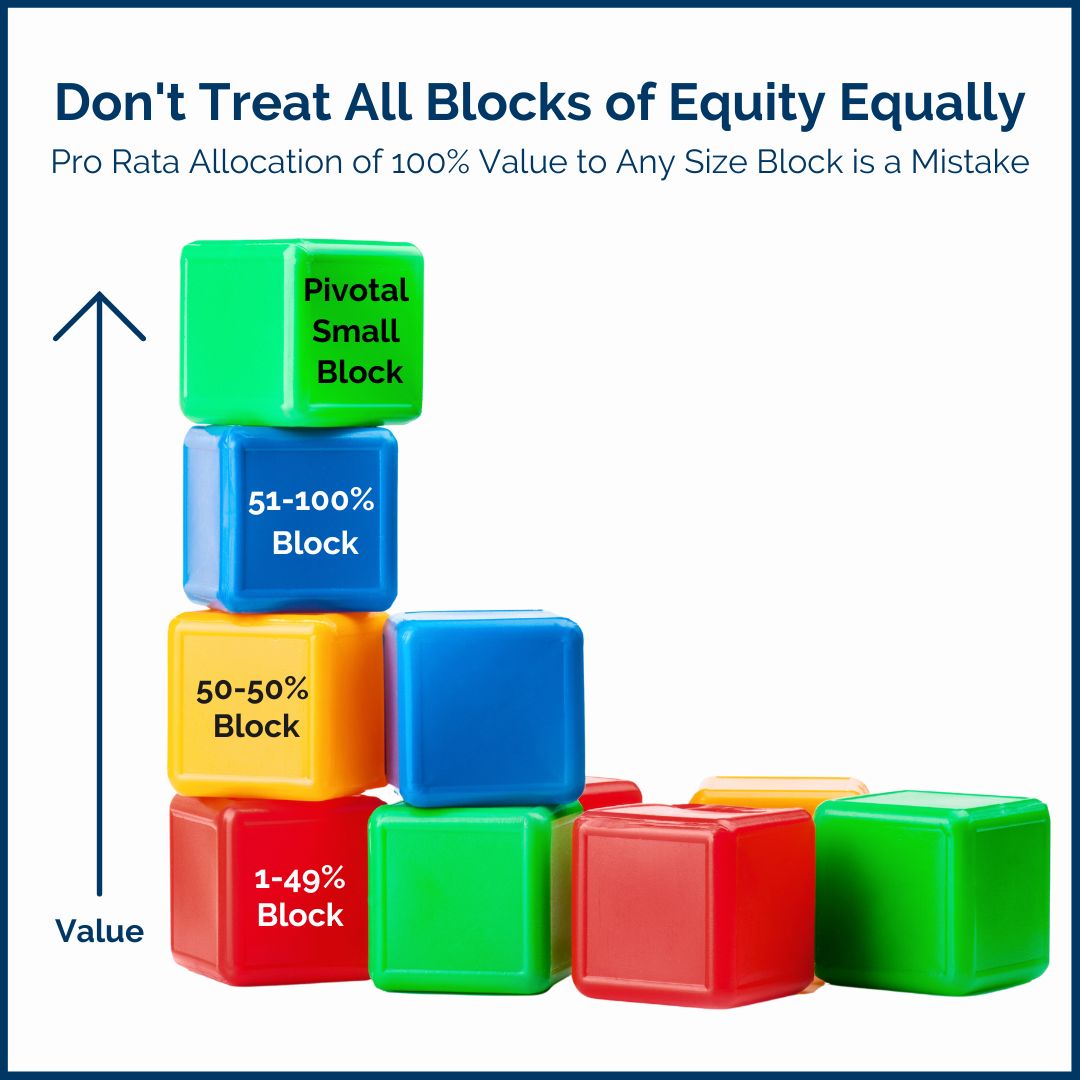

Avoiding a Frequent Mistake–Treating All Blocks of Equity (Ownership) Equally

Here’s a scenario we see occurring frequently: A 100% owner of a business wants to sell a 10% equity interest in their company to a key employee so they have some “skin in the game” and are less likely to leave and go elsewhere. Let’s assume the business owner has recently had a business valuationRead More…

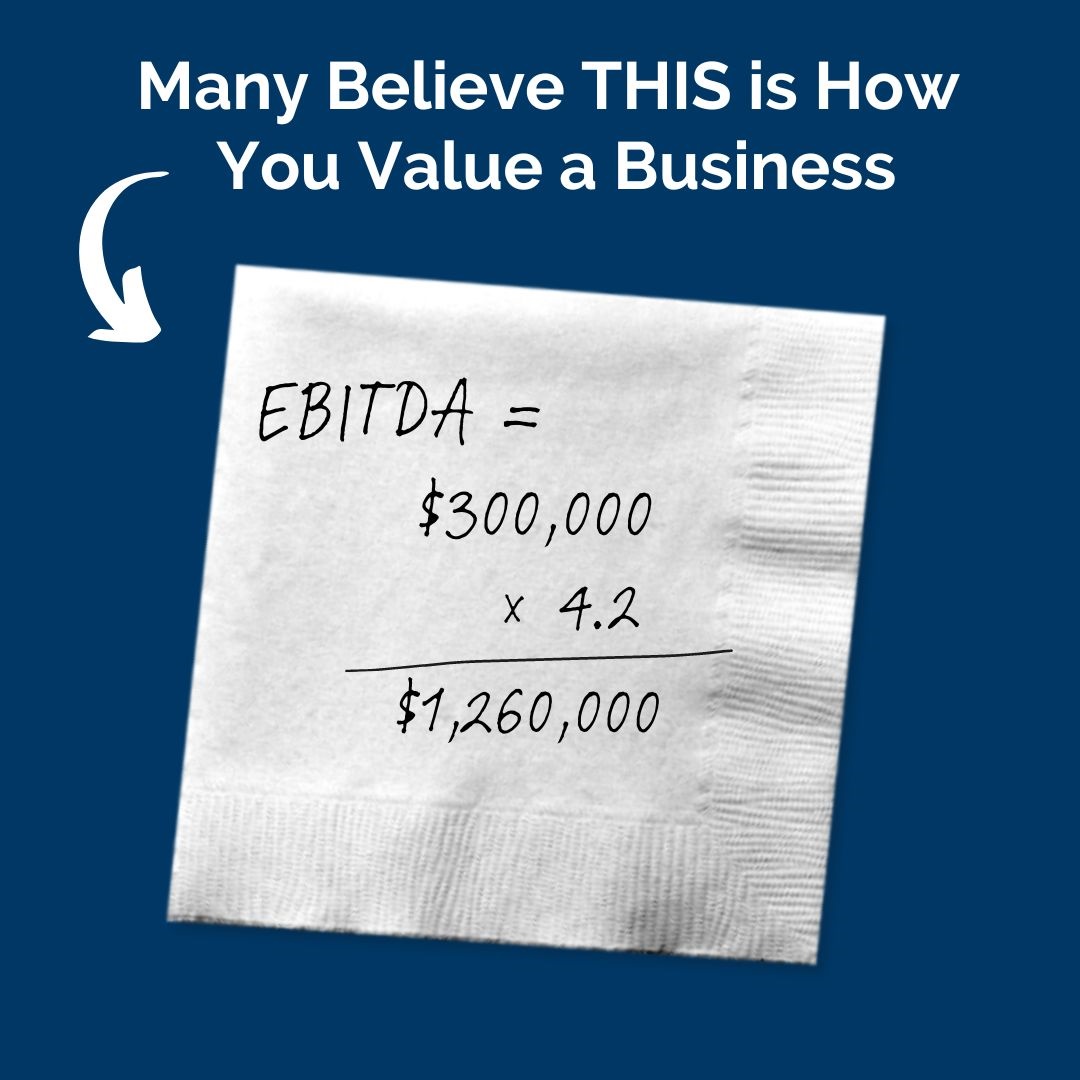

Business Valuation is More Than a Multiplication Equation

The risk of rushing to democratize business valuation The importance of business owners understanding the value of their business cannot be understated. Far too many business owners believe that a business valuation is not needed unless selling is imminent. This thinking stunts the owner’s ability to manage their business as an investment—to know with certaintyRead More…

Hot Topic for Your Next Client Meeting: Value Planning

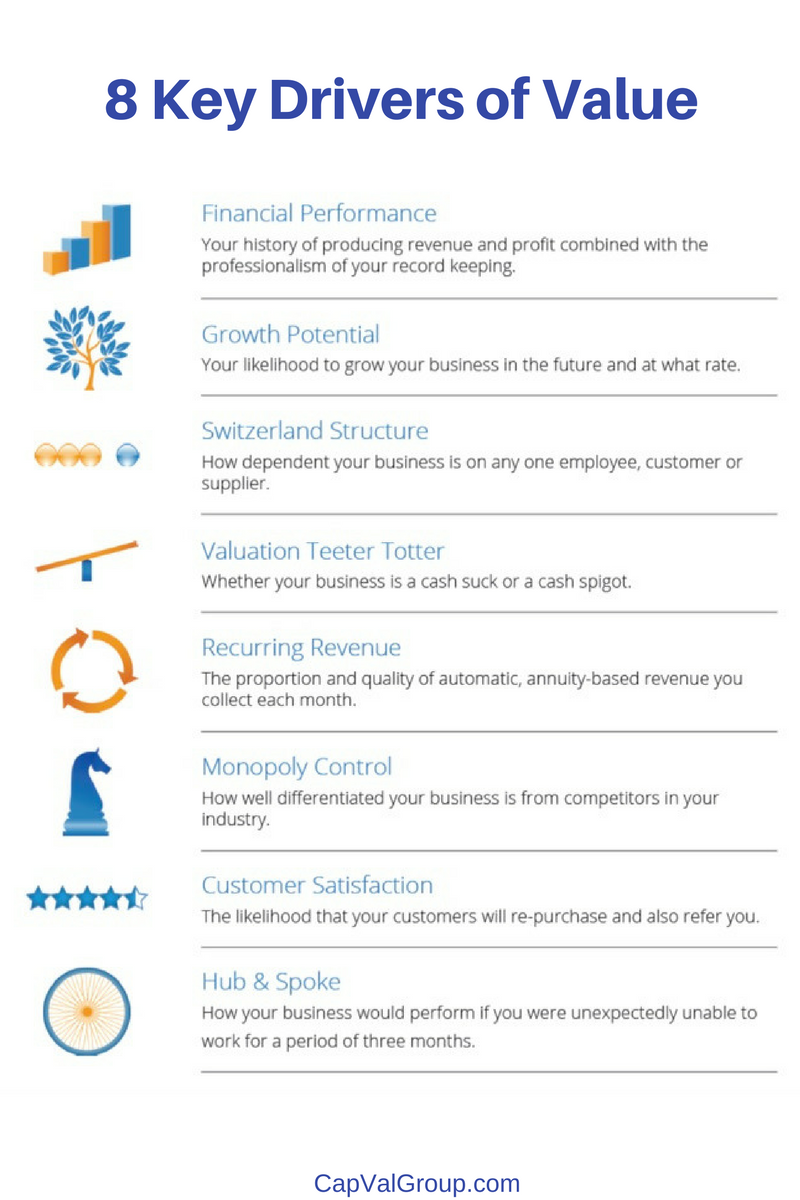

This time of year many business owners spend an inordinate amount of time looking at their financial statements, especially related to tax planning for their business. Business owners are keen on using their financial statements to work on tax planning but fail to see how time spent on value planning can increase the value ofRead More…

Don’t let your clients throw their year-end financial statements in a drawer…

January means it’s time for year-end financials, and as business owners everywhere are looking at revenues and profit numbers from the prior year, there is an abundance of insight hidden in the financial statements that many business owners are missing. What if you offered a unique conversation with the business owner that illustrates how theRead More…

COVID’s Surprising Impact on Business Value

Something notable happened with many business owners while managing through COVID that could impact the value of their businesses. It doesn’t have anything to do with their financials, and it doesn’t get much attention in the news. We’re talking about delegation. Many business owners responded to COVID by putting delegation of business operation decisions andRead More…

8 Ways to Build Value In a Family Business

Dear Cathy, What would you say are the key ways to build value in a family owned business? I find myself so busy every day and yet my company’s revenue growth has been stagnant despite my industry’s moderate growth trends. We are in the packaging industry and the company has been in my family forRead More…