We have to start thinking positively about the words “exit planning.” You say the words, and owners shut down – could be because of emotional attachment, the fear of change, lack of resources…. Could be worse – could be lack of awareness or procrastination. But guess what? Studies have shown that 75% of those whoRead More…

What is the Most Impactful Driver of Business Value?

We talk about the importance of understanding, increasing and unlocking the value of a business and while much of what we write and teach about relates to understanding how business valuation works, here we are focusing on increasing the value of a business. While there are many quantitative and qualitative levers that impact the valueRead More…

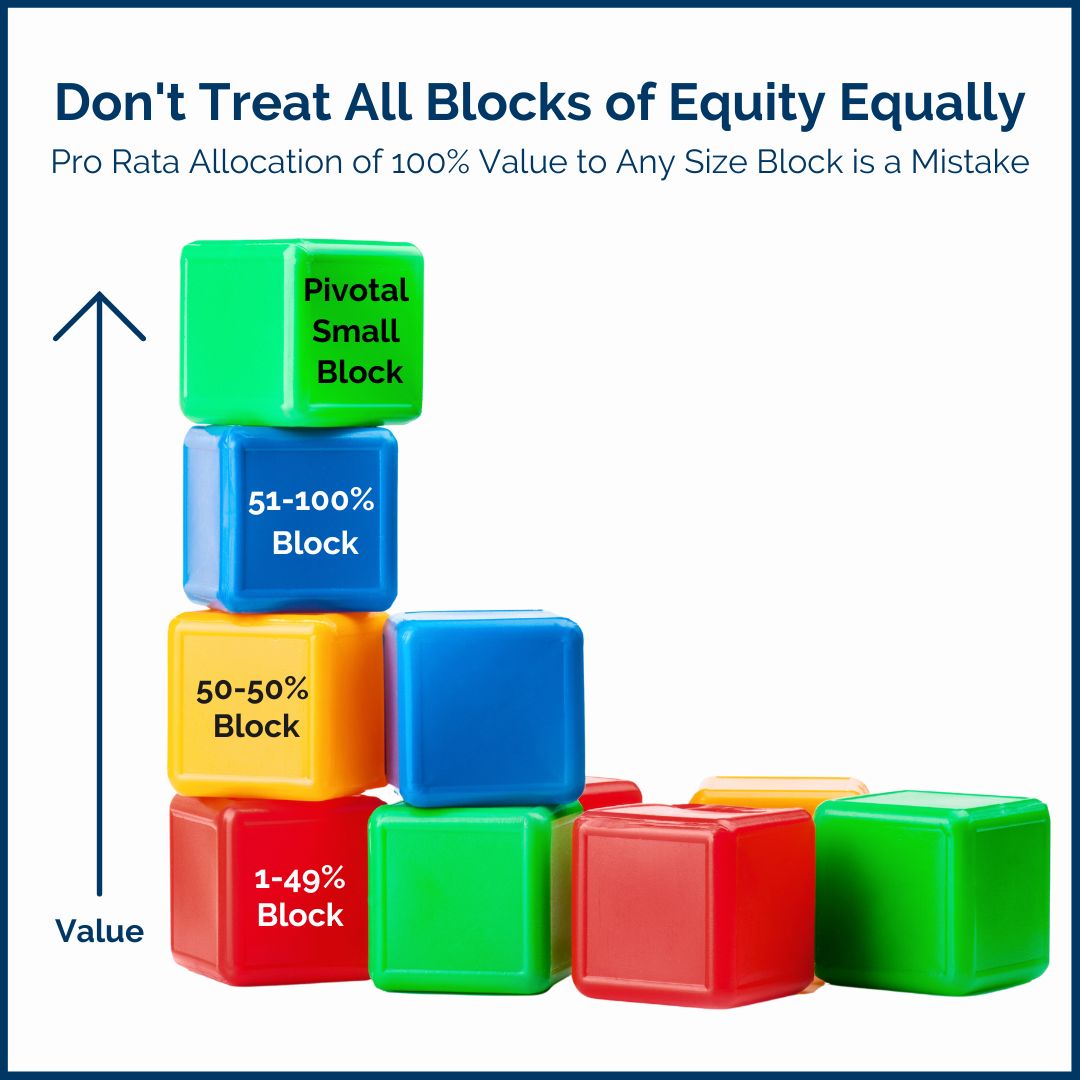

Avoiding a Frequent Mistake–Treating All Blocks of Equity (Ownership) Equally

Here’s a scenario we see occurring frequently: A 100% owner of a business wants to sell a 10% equity interest in their company to a key employee so they have some “skin in the game” and are less likely to leave and go elsewhere. Let’s assume the business owner has recently had a business valuationRead More…

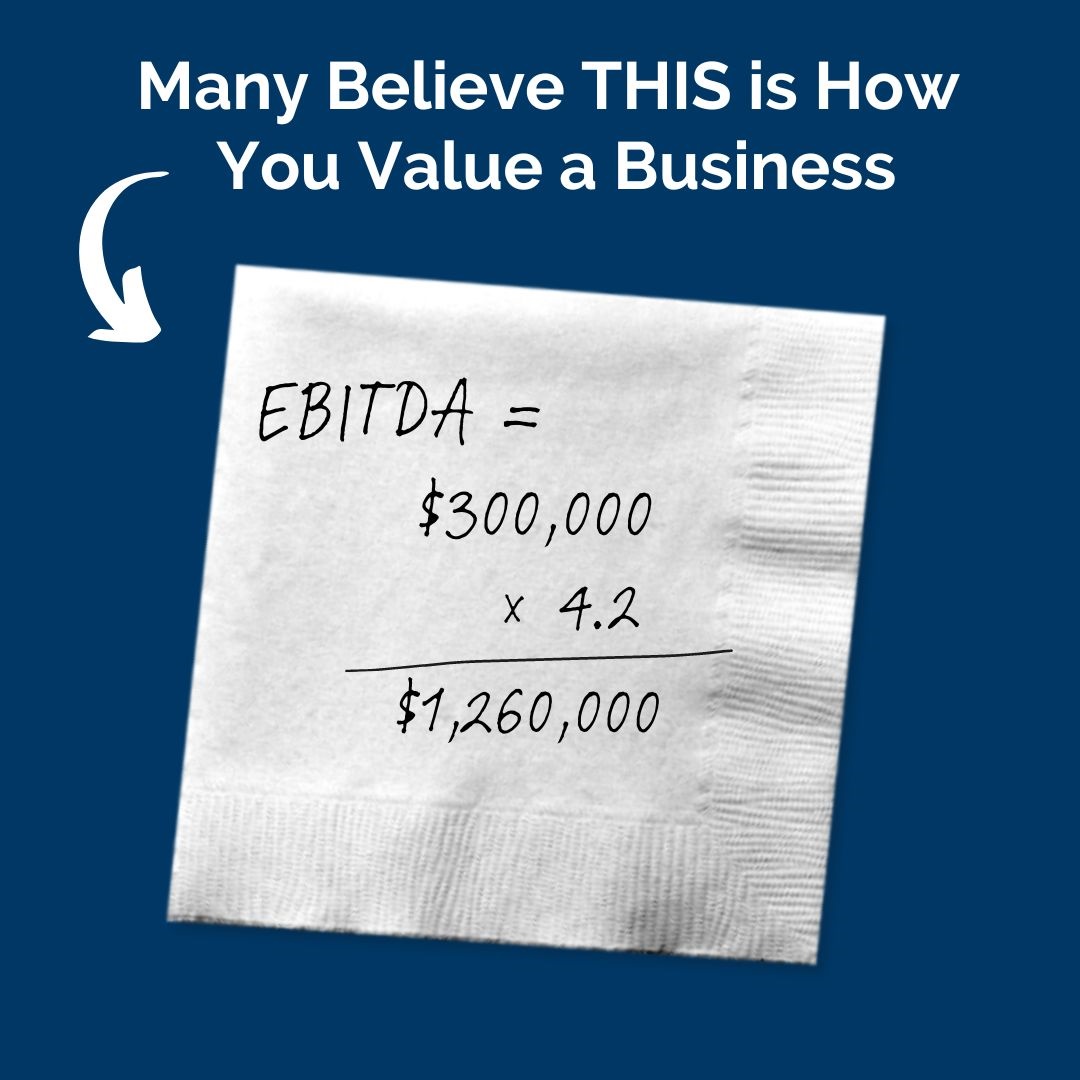

Business Valuation is More Than a Multiplication Equation

The risk of rushing to democratize business valuation The importance of business owners understanding the value of their business cannot be understated. Far too many business owners believe that a business valuation is not needed unless selling is imminent. This thinking stunts the owner’s ability to manage their business as an investment—to know with certaintyRead More…

Capital Valuation Strengthens Our Team as Marty Mathias Becomes Shareholder

Since CapVal was founded in 1974, we have made it our goal to maintain a team of professionals who have expertise in a variety of cross functional topics. Our founders discovered that different training, education, and experience leads each of us to approach the business valuation process from different perspectives. A business valuation or damagesRead More…

The Power of Having Your Business Ready for Sale At Any Time

There is no shortage of new ideas and books each year on how to best manage your business. Most of these business management books are providing ideas which will ultimately (hopefully!) result in increasing the value of your business as an investment. In actuality, when done thoroughly, the business valuation process encompasses an analysis andRead More…

Does a business owner’s ability to delegate impact business valuation?

We often talk about the importance of a business owner working to make their business less dependent on them. Let’s face it, the entrepreneurial personality is frequently very self-driven, and enjoys controlling their own destiny. In the beginning, often the business IS the owner. The owner wears numerous hats and takes on the majority ofRead More…

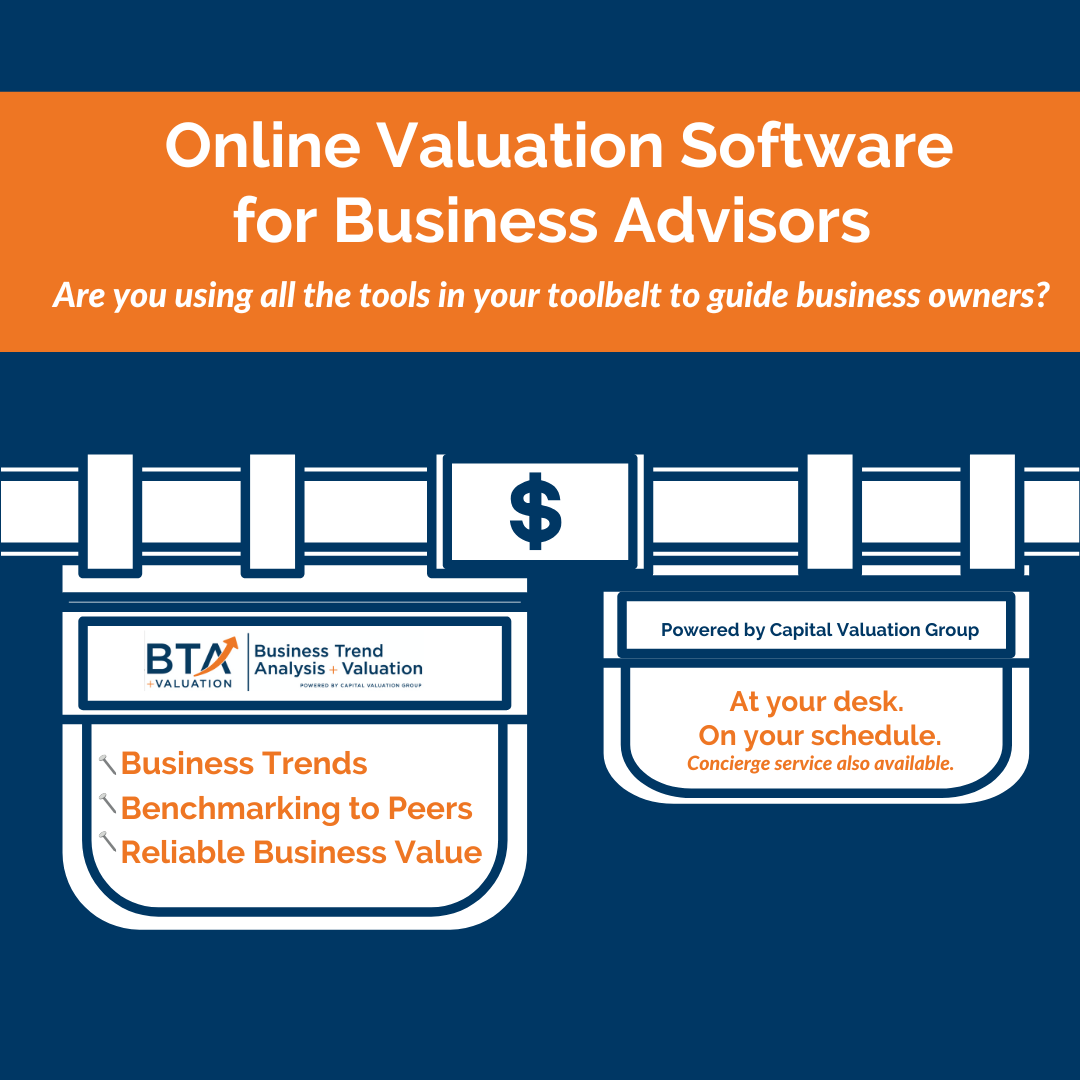

Are you looking for an online business valuation tool to determine a reliable value for business planning?

When talking with business owners and/or their advisors it is common for us to hear that the process of working together came to a halt when it was time to enter a value for their business. Business owners almost always have a good idea of the value of their home, investments, boat, car or otherRead More…

Capital Valuation Group Enters 3rd Generation as Jane Tereba is Named President

Succession planning is something we talk about on a daily basis as a part of business valuation. We always like to reinforce that shifts in the division of work and transition of leadership can happen long before anyone retires or sells their shares of a privately owned business. As our team at Capital Valuation GroupRead More…

When Starting the Conversation About Business Valuation Don’t Jump to Conclusions

Business owners or advisors will reach out to us needing a value conclusion and are sometimes surprised by the number of questions we ask before we even get started with the appraisal. These questions are critical to defining the scope of work and making sure, when we are finished with the assignment, that we haveRead More…