Numerous clients have shared recently that they are seeing an increase in unsolicited inquiries about purchasing their business, some of which are legitimate inquiries from buyers or business brokers. While it is natural to be excited that you are a ‘target’ for an interested buyer, it is critical to slow down, stay calm and respond,Read More…

LOCAL CPA EARNS EXCLUSIVE CREDENTIAL

FOR IMMEDIATE RELEASE Media Contact: Cathy Durham Capital Valuation Group, Inc. 608-257-2757 LOCAL CPA EARNS EXCLUSIVE CREDENTIAL “ACCREDITED SENIOR ANALYST” AS VALUATION EXPERT MADISON, WI MAY 6, 2021 – Jane Tereba, a CPA and damages and valuation expert with Capital Valuation Group, Inc. headquartered in Madison, WI, has recently been awarded the Accredited Senior Appraiser (ASA) CredentialRead More…

5 Ingredients Used for Pricing a Business

Last month we shared that while the value of a business can appear financially complex, at CapVal our goal is to break down complex business valuation topics to help business owners and advisors understand and maximize business value. At the highest level, the value of a business is based on two key factors: (1) futureRead More…

Business Valuation Does Not Have to Feel Like a Black Box

Anybody can Google the definition of business value: “the value of a business today is the present value of future economic benefits.” That is straightforward if you are a business appraiser, but for the average business advisor or owner, business valuation can feel like a black box. However, it does not have to be thatRead More…

Don’t fight over business value

When a business valuation expert, also known as an accredited business appraiser, sets out to value a business, they are looking at it as though there will be a sale. Sometimes a business is valued for an actual sale while for purposes such as gifting and divorce, a hypothetical sale is assumed. In all cases, aRead More…

Stop! Don’t let your clients throw their year-end financial statements in a drawer…

January means it’s time for year-end financials, and as business owners everywhere are looking at revenues and profit numbers from the prior year, there is an abundance of insight hidden in the financial statements that many business owners are missing. What if you offered a unique conversation with the business owner that illustrates how theRead More…

Time to Review These 10 Value Driving Activities

Nobody would argue 2020 has been an interesting year, but out of challenge can come opportunity. As we look back on the year, we thought it would be a good time for you to consider how you or your clients did on the list of value drivers we shared earlier this year in our 2-partRead More…

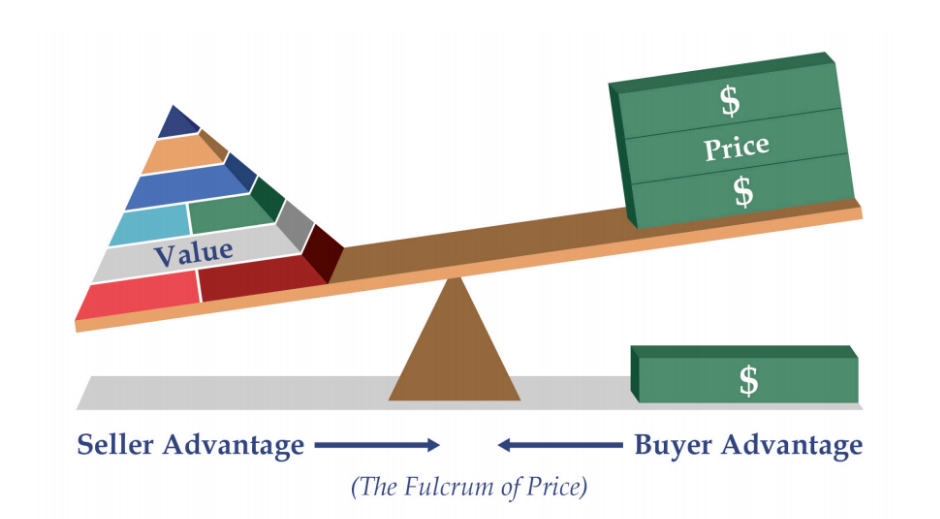

The Psychology of the Deal…Value Doesn’t Always Equal Price

Bargaining Position Matters. While they are frequently confused as being synonymous in the business world, the terms “value” and “price” don’t mean the same thing when it comes to business valuation. Every business ownership transfer involves negotiation, or bargaining, and bargaining position is a function of economic strength, knowledge, negotiating skills and timing. As such,Read More…

Meet David Mitten, the Newest Addition to Our Growing Team at Capital Valuation Group

David has joined the CapVal team as a Business Valuation Analyst, and with 12 years of experience doing financial analysis and business modeling, he has hit the ground running! You will see David in meetings and calls if you haven’t already, so we wanted to share this brief Q&A to help you get to know him.Read More…

Why Market Comps Drive Home Appraisals, Not So Much for Businesses

If you want to know the value of your home it makes perfect sense to look at recent comparable sales of other homes in your market. After all, this information is publicly available and provides a great deal of detail enabling you to find prior sales that are truly comparable. A quick internet search allowsRead More…