For business owners, understanding how business valuation works is crucial for long-term success. When you’re investing in your company, you’re typically aiming for growth, expansion, or increased efficiency—but did you know that these investments can actually decrease your business’s value in the short term? This phenomenon might seem counterintuitive to many business owners, but itRead More…

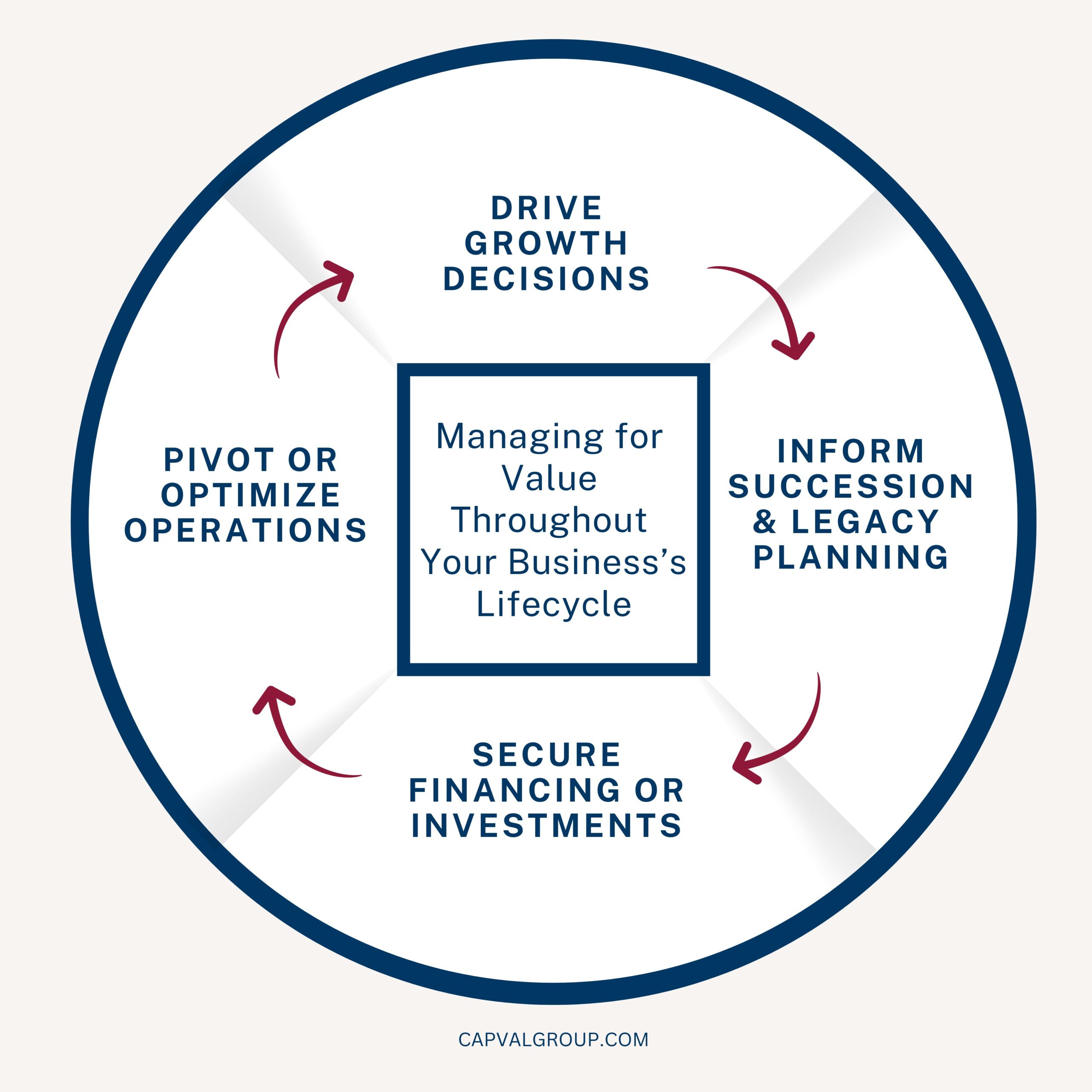

Beyond the Exit Strategy: Managing for Value Throughout a Business’s Lifecycle

Business valuation has long been seen as a tool reserved for exit planning. It’s often associated with the final stages of a business’s lifecycle, used to determine a company’s value for sale or handover. But viewing valuation solely through the lens of an endgame strategy is a missed opportunity. Business valuation offers powerful insights thatRead More…

Business Valuation: The Magic Number

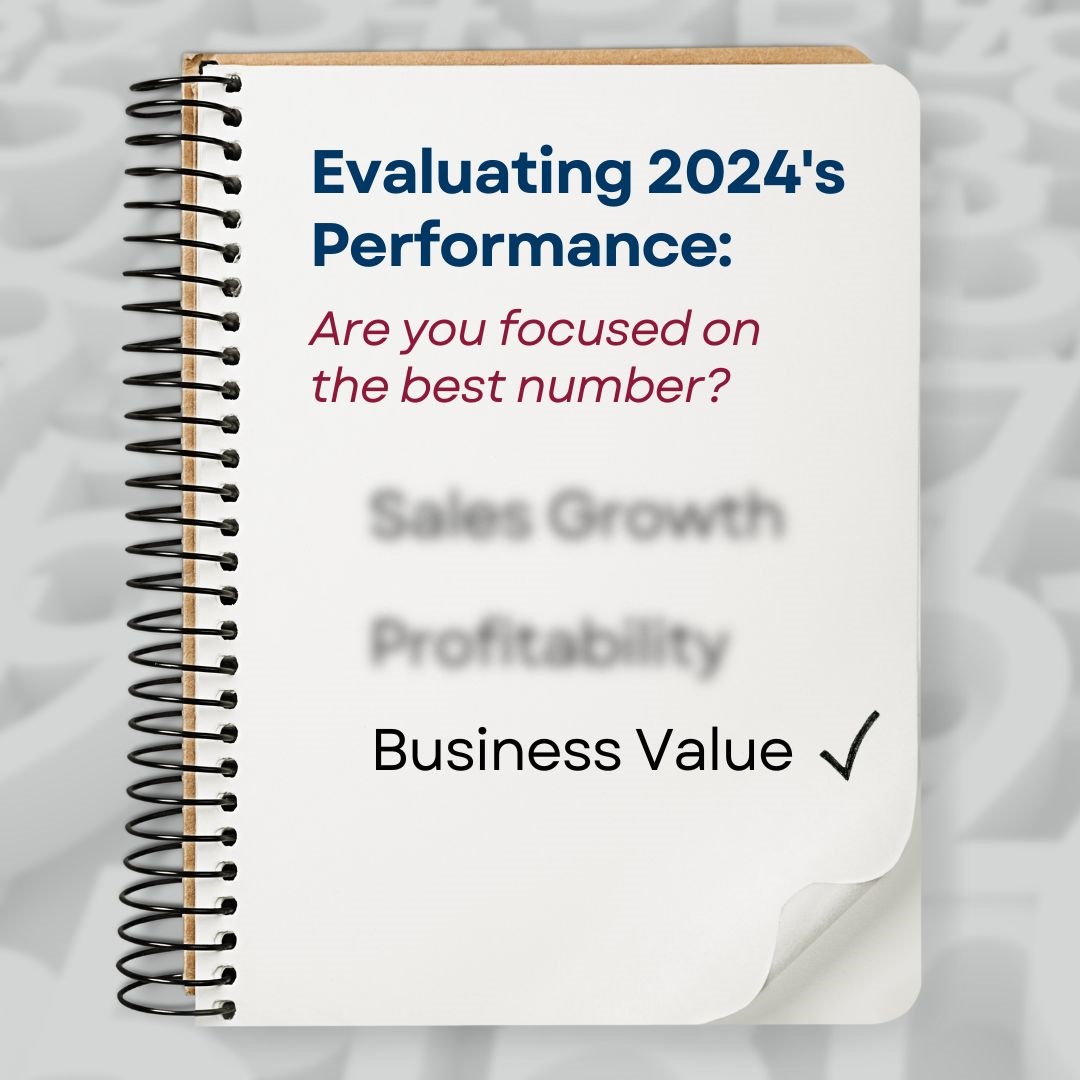

How did 2024 go? The one number that tells the whole story While these metrics are indicators of past performance, they don’t provide a full picture of the business’s overall health. For example: Even profitability can mask underlying issues. Is the owner neglecting needed reinvestments in technology, equipment, or facilities? Is high employee turnover tiedRead More…

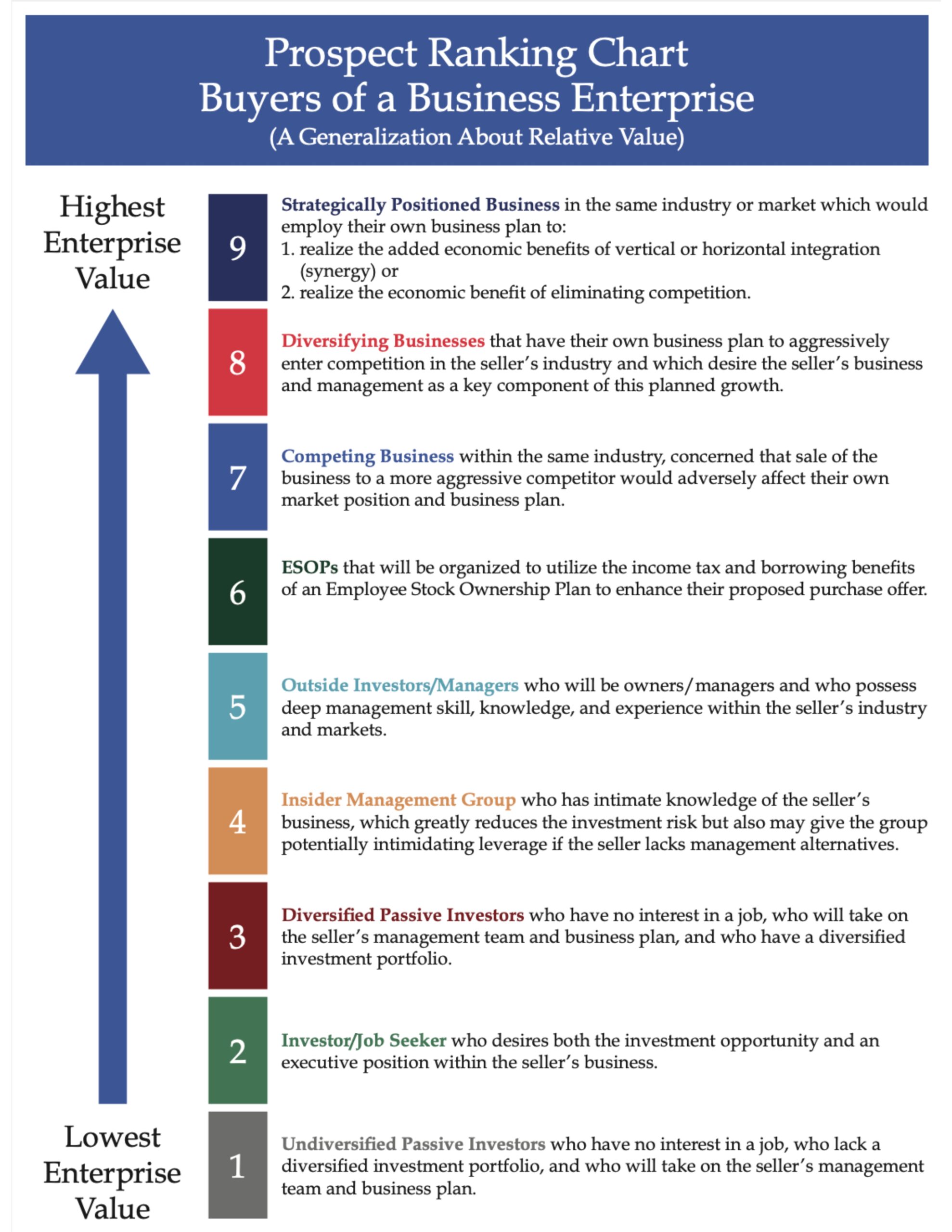

Business Exit Strategy: Which Type of Buyer is Right for You?

Different potential buyers of a business will arrive at very different values. Why? Because buyers have different interests, motivations, knowledge, and plans for what they might do if they become the owner. Generally, informed buyers calculate the value of a business with a focus on two key levers: 1. Future Expected Cash Flows: The income,Read More…

How to Build Value Today for a Future Exit

What if sales growth isn’t the whole story? Business owners begin by selling something—a product, a service, or adding value to existing products or services. As the business takes root and grows, it transforms from a mere idea and typically employment for the owner, into a significant investment, likely becoming the owner’s largest asset. InRead More…

Managing Your Business Like the Investment That It Is

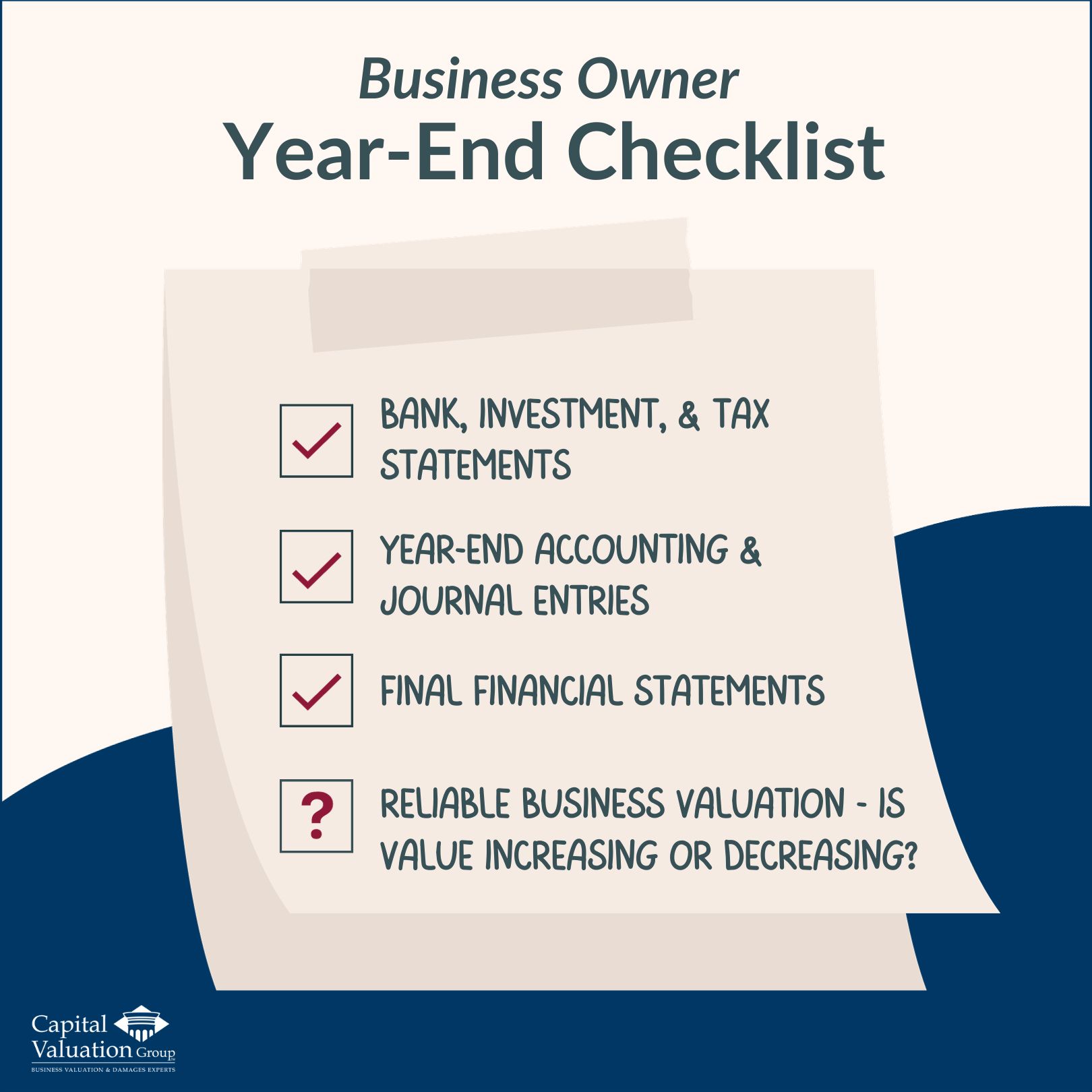

And another year is in the books! It’s time to gather and review our bank statements, investment statements, tax statements…and if a business is owned, wrap up year-end accounting and journal entries to finalize financial statements. But some business owners are missing one critical year-end statement that can be a competitive differentiator…a reliable business valuation.Read More…