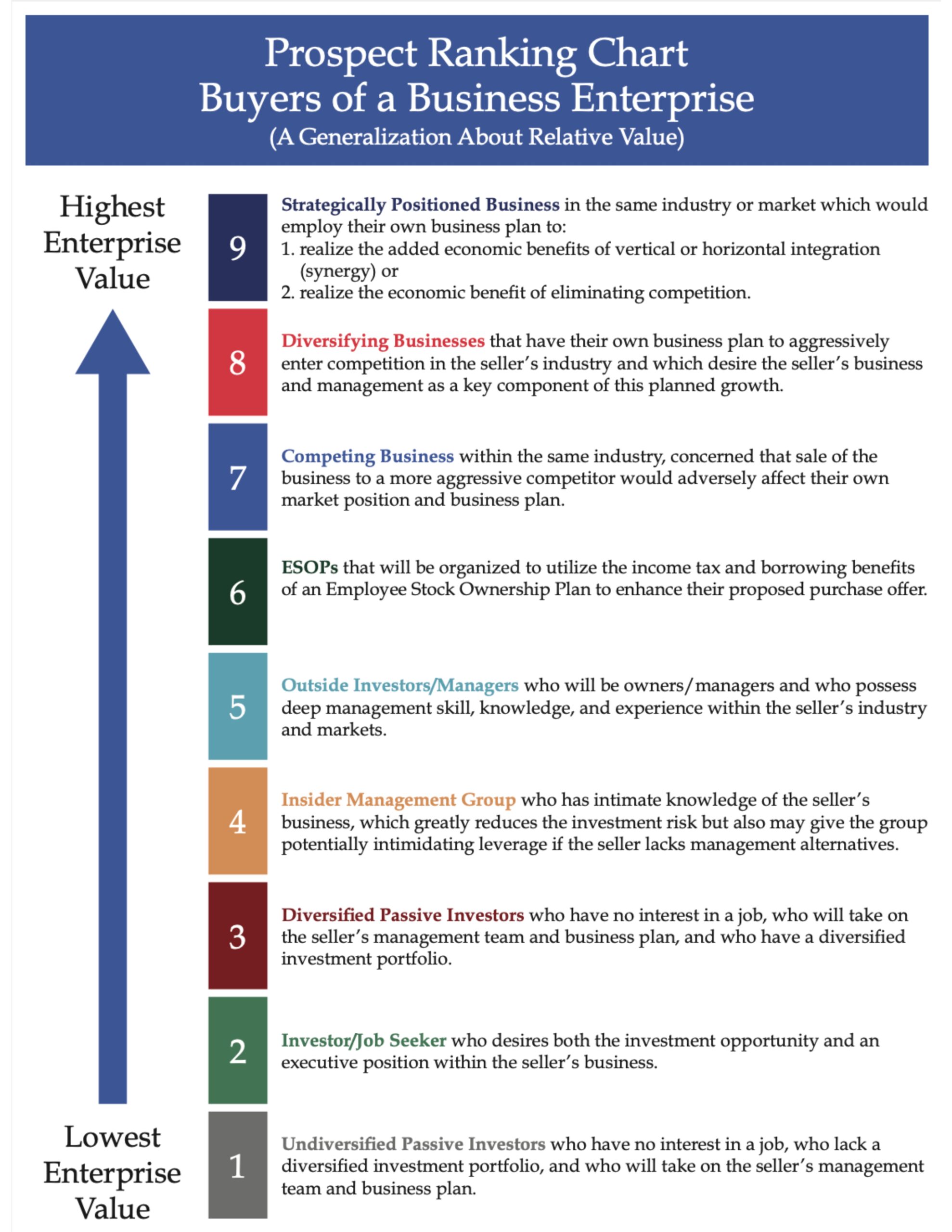

Different potential buyers of a business will arrive at very different values. Why? Because buyers have different interests, motivations, knowledge, and plans for what they might do if they become the owner. Generally, informed buyers calculate the value of a business with a focus on two key levers: 1. Future Expected Cash Flows: The income,Read More…

Buy/Sell Agreements: Proactively Defining How to Navigate Inevitable Ownership Transitions

As the saying goes…. “Don’t get into business with ANYONE without first defining how you’ll get out of ownership.” Starting a business or deciding to share ownership can seem straightforward initially. However, a critical aspect often overlooked is defining how each owner will eventually exit that ownership. After 50 years of working with business owners,Read More…

Exit Planning is Simply Good Business Planning

We have to start thinking positively about the words “exit planning.” You say the words, and owners shut down – could be because of emotional attachment, the fear of change, lack of resources…. Could be worse – could be lack of awareness or procrastination. But guess what? Studies have shown that 75% of those whoRead More…

Transitioning Ownership in the Service-Based Business

It was August 1999, nearly 25 years after Ted Gunkel founded Madison Valuation Associates, and he had an important choice to make. He could retire and sell the office furniture and computers, or he could pass the torch of ownership to the next generation of key employees of his valuation firm. Ted wanted theRead More…

Transferability

Dear Cathy, I’ve owned a plumbing business for 20 years. As I work with my financial planner on retirement planning, I need to gain a better understanding about the value of my business. A little background: I am a licensed plumber and do not have any employees, but my wife takes care of the businessRead More…