We were recently working with a successful Wisconsin business owner who has been working on his succession plan. During our initial meeting he was surprised to learn that every business has more than one value depending upon who the buyer is. He lamented he had no knowledge or experience in thinking through the different types of potential buyers of his company and who pays more (or less) for a business. Had he known this, he might have proceeded with his business ownership transition plan differently. This owner is not alone, and unfortunately this is a common area of confusion among business owners.

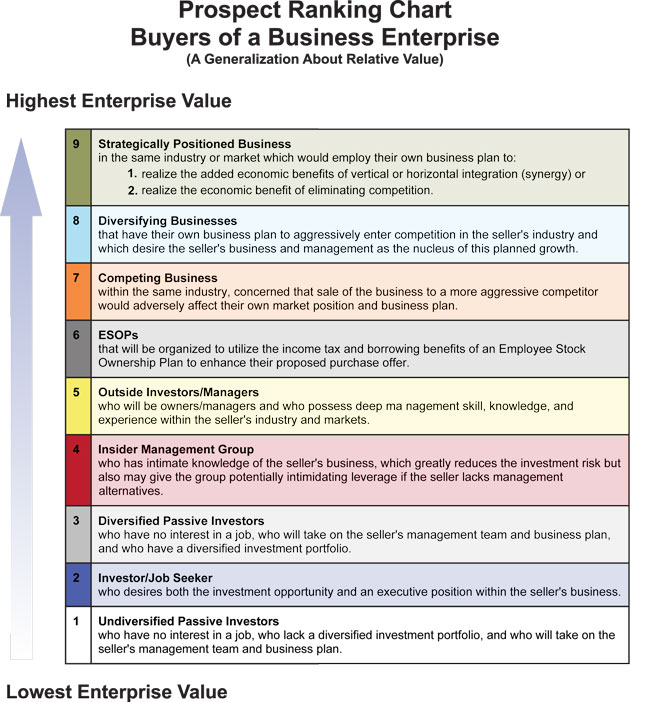

If you are a Business Advisor, you can use our Buyers’ Chart (see below) as you work with business owners to help them identify who the buyers of their business might be, how to position themselves for a specific buyer type and how this impacts value.

Buyer types 1-3 are characterized as a hypothetical, passive investors. This buyer doesn’t work in the business and accepts the seller’s management team and business plan. Due to the buyer’s lack of direct involvement the risk of this investment is increased and value is lowered.

Buyer types 4-6 are the most frequent buyers of privately held businesses. This buyer works in the business, understands the company’s processes, has connections to key customer and vendor relationships. This reduces the risk of the investment and value is increased.

Buyer types 7-9 represent the “strategic buyer.” This buyer is typically willing to pay more for a business because they can recognize increased cash flows in addition to reduced risks. There may be savings on duplicative operating expenses, the ability to increase prices due to less competition and gain of immediate market share, among other factors. Increased cash flows and reduced risk results in increased value.

Would you or your team like to learn more?

We're always happy to talk about success planning and business valuation with you or your team. Let us know how we can be of help so your clients won’t be the ones wishing they knew this information earlier!

Cathy is the President of Capital Valuation Group, Inc., headquartered in Madison, WI. Capital Valuation Group has been helping business owners across the country understand, increase and unlock the value of their businesses for over 40 years through keynote speaking, valuation analysis, determining damages and providing expert witness testimony. Cathy welcomes conference and event speaking inquiries and can be reached at cdurham@capvalgroup.com.