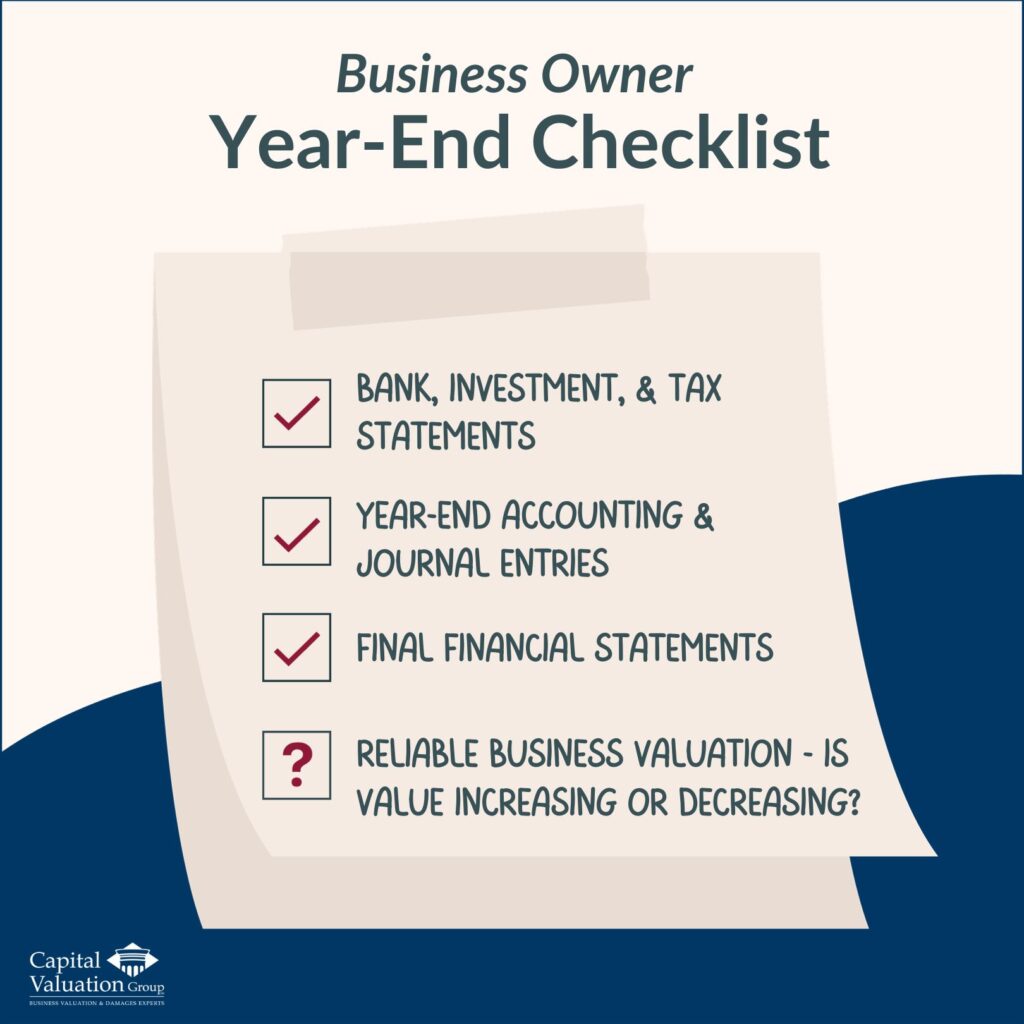

And another year is in the books! It’s time to gather and review our bank statements, investment statements, tax statements…and if a business is owned, wrap up year-end accounting and journal entries to finalize financial statements.

But some business owners are missing one critical year-end statement that can be a competitive differentiator…a reliable business valuation.

A privately owned business is most often the owner’s largest asset. Yet, as we’ve written about in the past, business owners will go 30+ years without ever knowing the value of this largest asset. Imagine going 30 years without checking how your 401(k) or other investments are doing!

Business owners might think they don’t need to know the value of their business until they are ready to sell; when actually, significant management and planning opportunities are missed in terms of managing the business as an investment.

While a completed valuation answers the question, “what is the value of my business today?” it is the process of having a business valued where the longer-term benefits exist. Our valuation process, as hundreds of business owners have told us, provides a different “look” at the business than they have had before. This fresh perspective helps owners better understand the past financial performance and identify the drivers of value. This not only helps with future management decisions but points to how value can be increased over time. These insights include:

- An understanding of the historical trends over the past five years. While this sounds rather mundane, it’s amazing how many owners reviewing this data with a new lens say, “what is going on with my cost of labor, gross profit margin, insurance premiums, advertising, etc….” and we dig in to find answers together. Owners tend to focus on trends in sales growth but trends determined in business valuation tell the story behind the numbers of all the variables. They warn an owner of margin creep and once these trends are analyzed, the owner knows where to focus in the future to improve/increase value.

- How am I doing compared to others in my industry? CapVal’s business valuation process includes researching the general economy and relevant industry, then comparing how the subject business has performed relative to peers, as well as the industry outlook.

- A reliable business valuation goes beyond the financial performance of the company. It includes identifying the qualitative factors that increase/decrease value. For example:

- how dependent is the business on its owner(s)?

- is the business dependent on a few larger customers/clients?

- is the company culture positive?

- does the company have capacity to grow?

- does the business have outstanding legal or environmental issues?

- what are the barriers to entry?

- does the company consistently re-invest in the assets of the business?

- is the competitive environment changing?

- how strong is the company technologically?

- how long has the business been in existence and how strong is the company’s brand and reputation?

Such qualitative factors (and there are more than those listed) are measured by the level of risk or opportunity each represents to a particular business. If the company has risk in a particular qualitative factor, it results in lower value. If the company has opportunity, or manages the risk, the result is higher value. These factors would certainly be considered by an interested buyer of the business. Once a business owner knows how the business is currently performing relative to these factors, they can strategize where to focus their energies in the future to ultimately increase value.

In summary, with time, the value of a business can absolutely be increased. But how can the owner of a business evaluate whether the value of the business—likely their largest asset—is increasing or decreasing? Regularly measuring and understanding the value of one’s business provides an annual report card of how that year’s management decisions have impacted value; and possibly more importantly, can provide a strategic tool for identifying future next steps to manage the business as the investment that it is.

If you would like to discuss a specific business situation please reach out to us through our Contact page or call us at 608-257-2757 and one of us would be happy to talk with you.