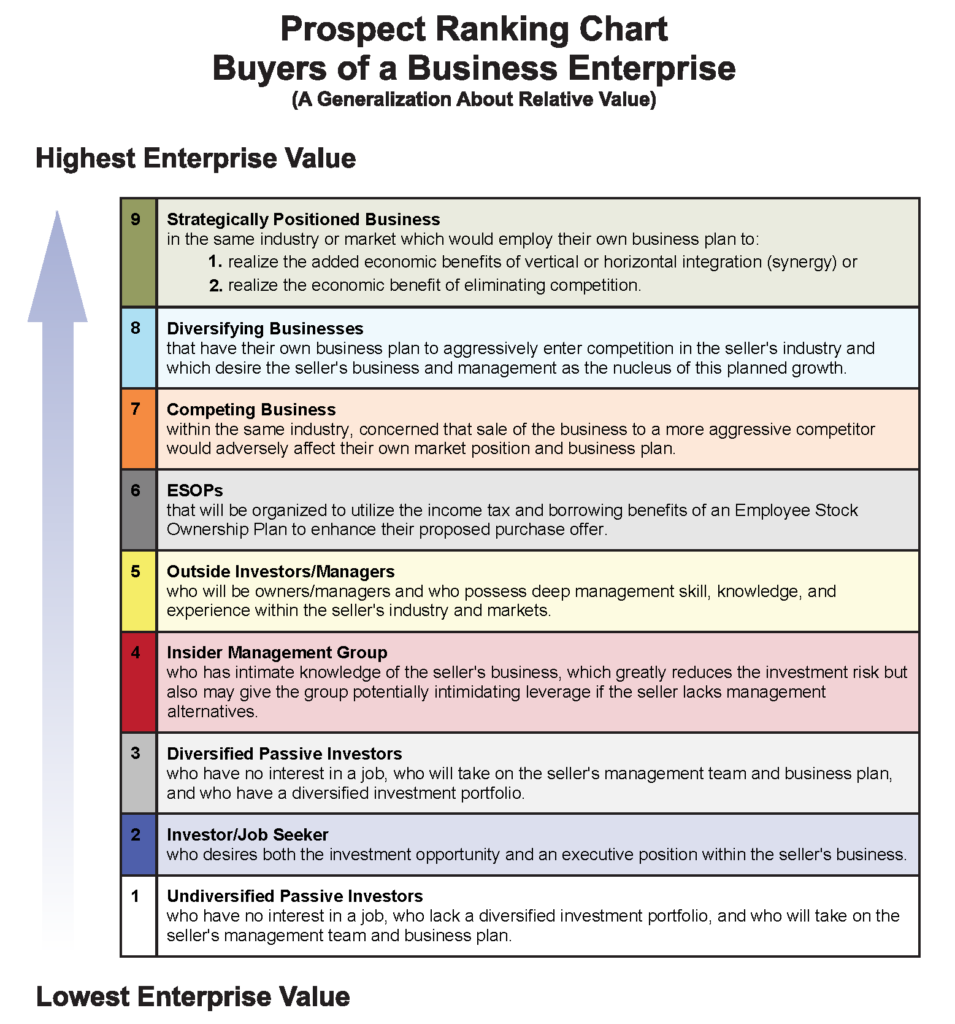

As you may have heard us say previously, every business has more than one value, depending upon who the buyer is. Different types of buyers are motivated differently based on what they could do with the business if they were to own it, as highlighted on our Buyer’s Chart. For example, some buyer types are highly motivated by the synergies that could be recognized by the combination of the target company with their own (see buyer types 7-9 on the chart); while other buyer types might be more motivated by a passive return on their investment (see buyer types 1-3 on the chart). These differing motivations can impact value and the ultimate sale price.

This month we are focusing on the strategic buyer - the buyer who is typically willing to pay a higher price for an equity interest in a business. Let’s look at what is meant by a strategic buyer, who these buyers are, and why they are willing to pay more.

To begin, it’s helpful to understand what we mean by a “strategic buyer.” Such a buyer is almost always another operating business or organization seeking one of two things: more rapid revenue growth or gained efficiencies through acquisition. The buyer could be interested in geographic expansion, gaining an established workforce, gaining an established customer base, or leveraging saved costs—and choosing to do so more rapidly than starting a new business and growing it organically.

For most businesses the strategic buyer is typically:

- another similar business—sometimes a competitor, or a company looking to expand their geographic footprint (this is frequent when a particular industry is going through consolidation), or

- a business looking to expand their capabilities (products or services) through vertical growth, or

- a business that is outsourcing what the seller offers and is looking to bring it in-house, or

- a business looking to expand their workforce and related skill sets, or

- a business looking to lock in a key supplier relationship (again, vertical growth but also motivated by a desire to control the key supply chain and related profit center).

As any buyer considers the value of a business they are interested in two fundamental things:

1) the future expected cash flows that would be available to them after operating and making necessary reinvestments in the business; and,

2) the risks of those cash flows occurring.

The Strategic Buyer is more likely to be the buyer willing to pay a higher price for the business due to a number of factors. Typically, they can save on duplicative expenses, thereby increasing cash flows. These expenses might include such things as no need for two internal accountants/controllers/CFOs, no need for two external accountants or other professionals such as payroll processors, attorneys, or employee benefit administrators. There may also be duplicative management roles or locations that will no longer be necessary in the combined entity.

If the target business was previously a competitor it may be possible for the new combined entity to increase pricing, thereby increasing total revenues. It may also be possible for the new entity to negotiate for larger volume purchases, thereby reducing their cost of raw materials and/or overhead expenses and increasing the company’s margins.

It is wise for business owners, whether ready to sell today or in a few years, to consider who the strategic buyers might be in their world and to find ways to be known to such buyers. This can occur through attending industry conferences, writing in industry publications or speaking at conferences regarding successes or best practices.

Sometimes a sale to a strategic buyer is as much about timing and being ready when the opportunity strikes. A business owner that thinks about their business as both their job AND their investment is consistently planning for the day they exit. Then they can confidently respond to acquisition inquiries, versus feeling rushed to react.

Our CapVal team is happy to answer any questions you may have regarding Strategic Buyers or any of the types of buyers included on our Buyers Chart.

If you would like to discuss a specific business situation please reach out to us through the Contact page or call us at 608-257-2757 and we’ll connect you to a business valuation expert on the Capital Valuation Group team.