How did 2024 go? The one number that tells the whole story While these metrics are indicators of past performance, they don’t provide a full picture of the business’s overall health. For example: Even profitability can mask underlying issues. Is the owner neglecting needed reinvestments in technology, equipment, or facilities? Is high employee turnover tiedRead More…

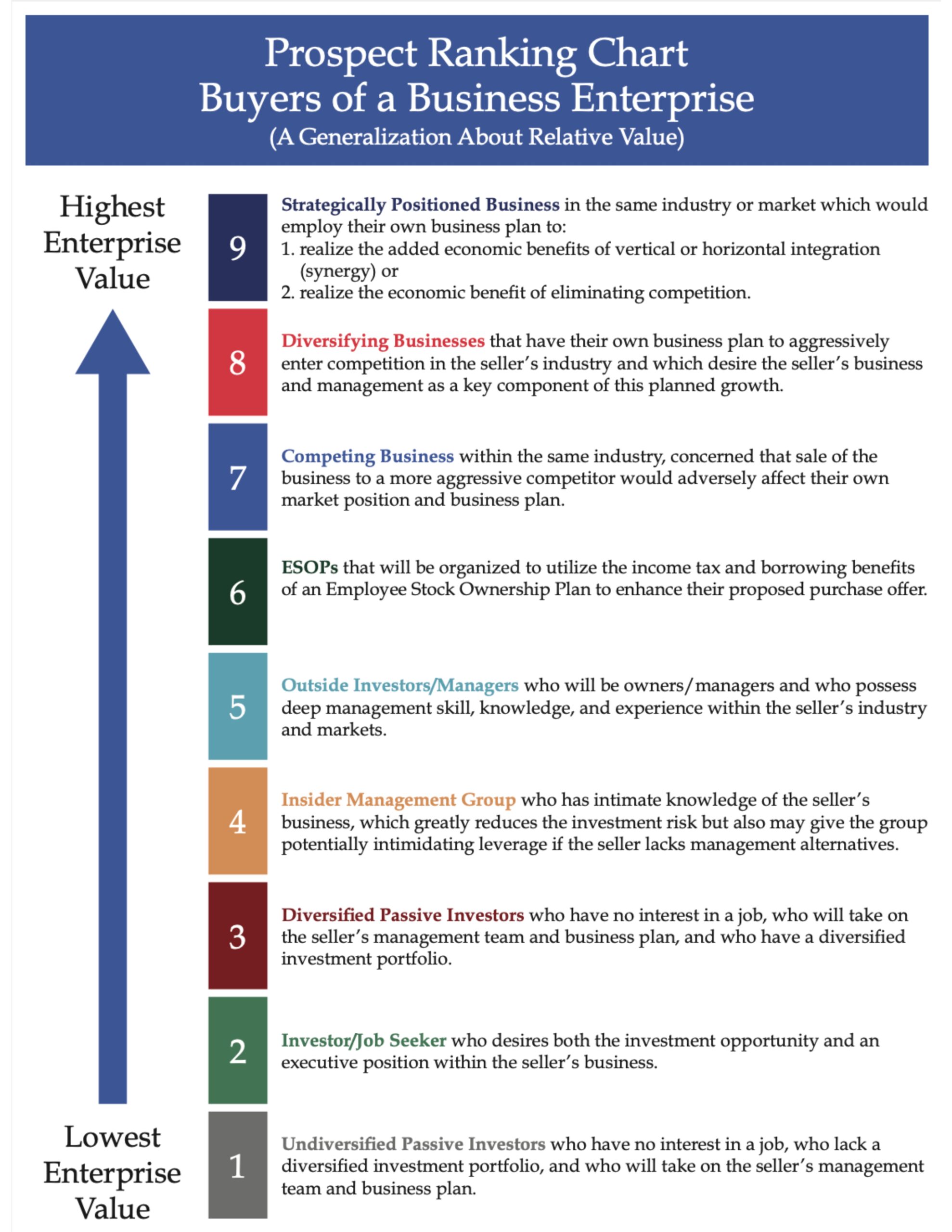

Business Exit Strategy: Which Type of Buyer is Right for You?

Different potential buyers of a business will arrive at very different values. Why? Because buyers have different interests, motivations, knowledge, and plans for what they might do if they become the owner. Generally, informed buyers calculate the value of a business with a focus on two key levers: 1. Future Expected Cash Flows: The income,Read More…

Prevent Lost Opportunity: Know the Value of Your Business

It’s often said that a business is worth whatever someone is willing to pay for it, so why should a business owner bother with a formal valuation, especially if they have no immediate plans to sell? After 50 years of valuing closely held businesses and assisting owners in preparing for ownership transitions, we’ve found thatRead More…

How to Build Value Today for a Future Exit

What if sales growth isn’t the whole story? Business owners begin by selling something—a product, a service, or adding value to existing products or services. As the business takes root and grows, it transforms from a mere idea and typically employment for the owner, into a significant investment, likely becoming the owner’s largest asset. InRead More…

Discounts for Lack of Marketability—What are they and why are they needed?

Experienced business appraisers consider various factors when valuing a privately owned business, one of which is known as the discount for lack of marketability (DLOM). This discount for lack of marketability represents a deduction from the value of an ownership interest to reflect the limited marketability, or ease of sale, of a privately owned business.Read More…

How Has the General Economy Affected Business Value?

There are many day-to-day decisions that we as business owners control and can adjust for; however, one significant issue that is completely out of our control is the general economy. It’s interesting to reflect back over the past two years of business valuations our firm has completed and consider how the more recent economic changesRead More…

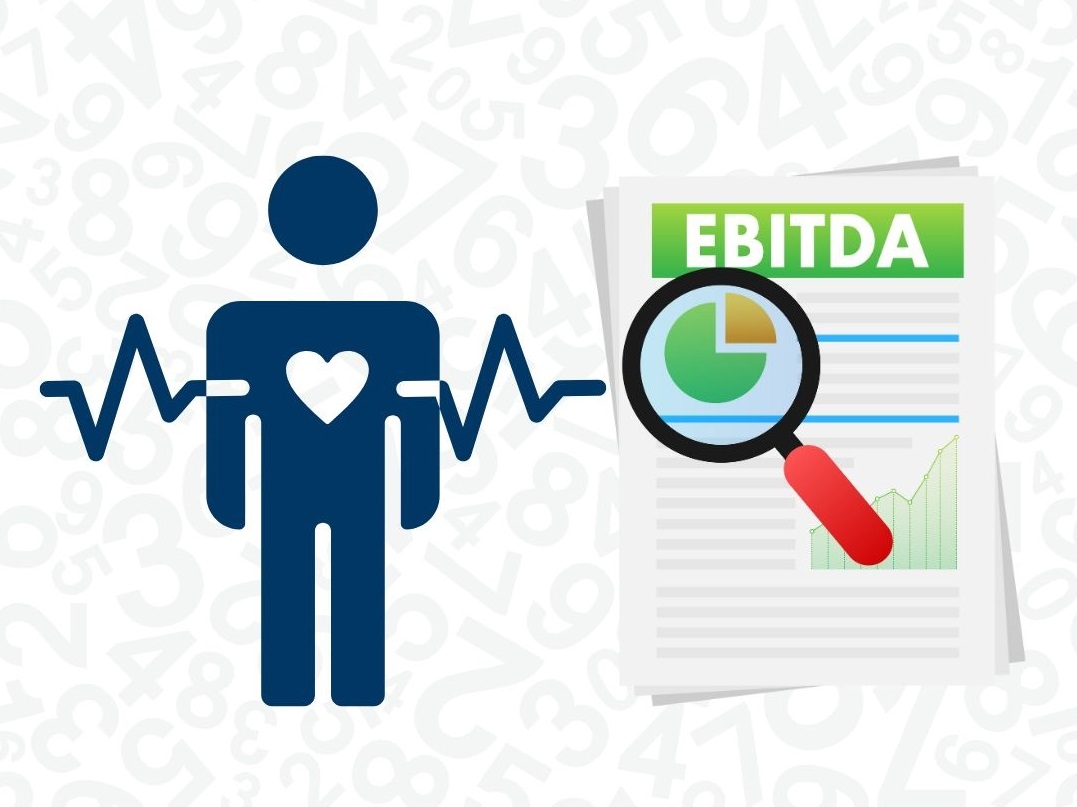

“It’s a Numbers Game” – Except for Healthcare and Business Valuation

I recently sat in a medical clinic waiting for a friend’s procedure to be completed when I came upon a New York Times article that stated it is our life expectancy, not just our age, that is increasingly figuring into calculations about whether certain medical screenings and treatments are appropriate. The crux of the articleRead More…

TIME to Drive Business Value (Part 2)

Business valuation includes considering both quantitative performance and qualitative factors. Last month we suggested five qualitative drivers of business value to work on during COVID-19. Here are five additional qualitative factors for you and your team to consider: Value Lever #6 – Researching Alternative VendorsJust as reducing dependency on any one customer or key employee is wise, reducing dependency onRead More…

Transferability

Dear Cathy, I’ve owned a plumbing business for 20 years. As I work with my financial planner on retirement planning, I need to gain a better understanding about the value of my business. A little background: I am a licensed plumber and do not have any employees, but my wife takes care of the businessRead More…