Are you wondering what the value of your business is if you sold to a competitor or other type of “best fit” buyer, (i.e., buyer with a strategic interest in the acquisition of your business)?

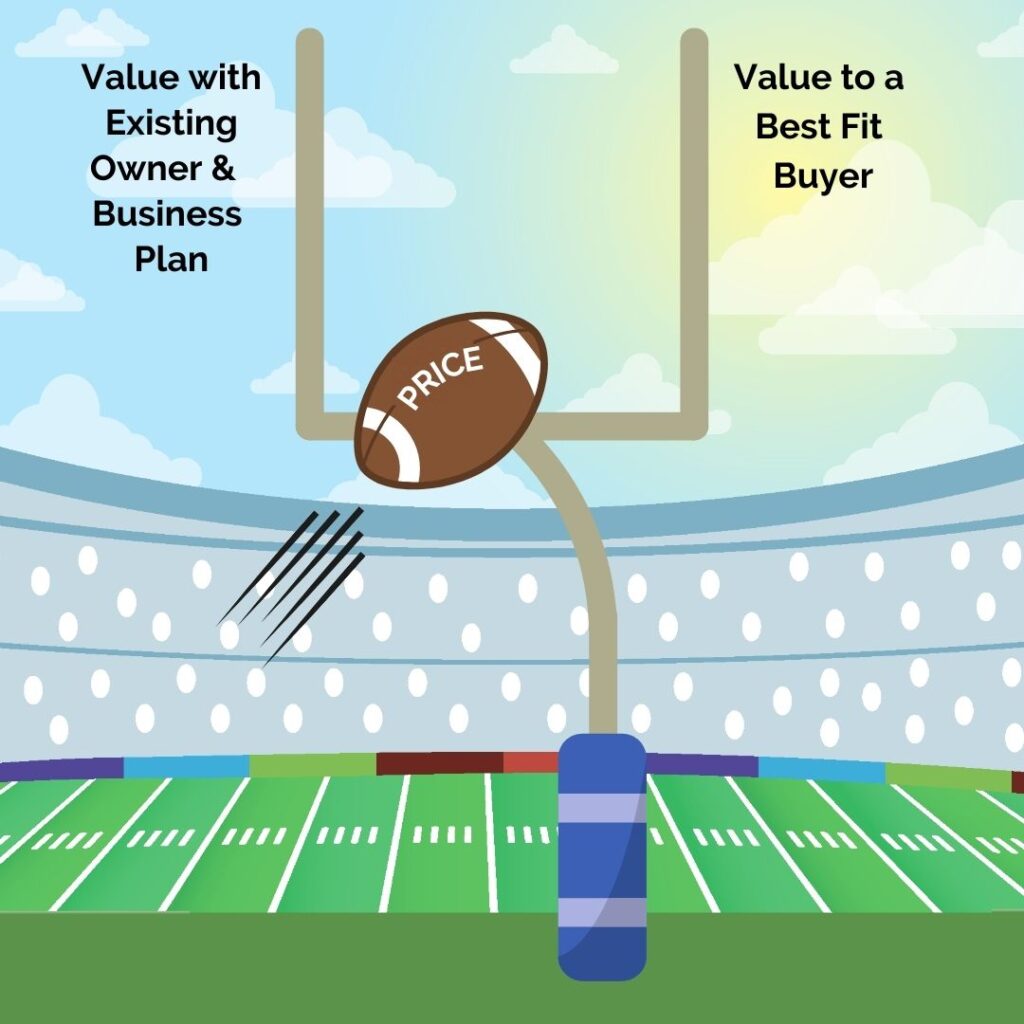

Different than selling to an inside employee group or passive investor, the sale of a business to a best fit buyer warrants two value conclusions (fortunately this doesn't mean paying for two valuations!). We think of these two values as the "goal posts of value."

Before we discuss these goal posts of value, it is important to remember that business value has two primary drivers that any wise buyer would focus on: future expected cash flows and the risk of those cash flows occurring as projected (reflected in a discount rate). Now, back to the goal posts!

The first goal post is the answer to “What is the value of my business under my continuing business plan?” The second goal post is the answer to “What is the likely value of my business to a specific best fit buyer?”

If we are measuring the value of your business to YOU as a continuing owner, we would use your current knowledge and business plan to build projections of the future expected cash flows. Next, we would determine a discount rate that reflects the risk of these cash flows occurring as projected and calculate the present value of the cash flows using this discount rate. Alternatively, if we are measuring the value of your business to a best fit buyer, we would reconsider and restate the cash flow projections and level of risk in order to estimate the likely benefits this specific best fit buyer would realize, should they buy your business.

Let's assume the buyer is your competitor. By purchasing a competitor, the buyer may achieve any or all of the following benefits:

- Ability to increase prices as there is no longer the same level of competitive pressure in the marketplace.

- Ability to gain volume in purchases enabling the potential negotiation for better pricing (higher discounts). This would result in higher gross profits for the buyer.

- Ability to do away with duplicative operating expenses. For example, two businesses combined into one possibly no longer require two accountants or two (or more) locations.

- A competitor already knows the industry and can immediately take advantage of the expanded geographic footprint gained in the purchase. This buyer already knows the 'sandbox' they are getting into, which reduces the risk to the buyer, thereby increasing value.

These benefits of increased revenues, decreased expenses, and lower discount rate are estimated and applied to the seller’s original projections to estimate the value specific to the competitor/buyer.

Knowing both of these goal posts of value prepares the seller to head to the negotiating table well informed. Will the buyer likely argue that the increased cash flows are something they will have to implement or achieve after the purchase, and therefore they don’t want to pay the seller for such increased cash flows? Yes. Instead, the buyer wants to pay the lower value of the business under the seller’s continuing business plan (the first goal post). But now, the wise seller argues that those benefits cannot be realized without the established business they have created—they have a critical piece of the puzzle for the buyer to recognize the savings (more quickly than starting from scratch).

Typically, the selling price is somewhere between these two goal posts of value. If the buyer is more motivated to buy than the seller is to sell (whether real or perceived), the purchase price will be closer to the second, higher goal post. Alternatively, if the seller is more motivated to sell (i.e., diagnosed with an illness or just burnt out) the purchase price will be closer to the first goal post, the lower value.

The terms of payment and requirements for transitional services are also key items that are regularly negotiated and can impact the ultimate purchase price. If the seller is paid 100% cash up-front versus waiting 3 to 5 years for payment; or, for example, if there are earn-out provisions attached to the buy-out terms, this can certainly have an impact on the ultimate price agreed upon.

Why two goal posts? It goes back to an earlier blog explaining the psychology of the deal when selling a business, where we explained that value and price are not the same thing. The value conclusion(s) is what is needed to go to the negotiating table and open the dialog; whereas price is the final transaction agreed upon. Price ultimately reflects the impact of all kinds of negotiated factors such as motivations of buyer and seller and the ultimate payment terms, to name just a few.

As a side note, this is also why it can be dangerous to assume the value of a business purely based on “market comps,” or multiples, of the sale of another seemingly similar business. There are many terms of the agreement for the sale of a business that don’t necessarily show up in the final sales price of these market comps.

When a business owner goes to the negotiating table, they need to know the value of their company under their continuing business plan, as well as the estimate of value for the company under the buyer’s business plan. Ultimately, when business owners only think of the value of their continuing business plan, they may well be leaving money on the table.

If you would like to discuss a specific business situation please reach out to us through our Contact page or call us at 608-257-2757 and we’ll connect you to a business valuation expert on our team.