Business Owners

Whether you’re running a family business passed down through generations or launching a brand-new startup, it’s important to think about how to maximize your business’s value for the future. Your decisions today directly influence your company’s long-term value when it’s time to transition your ownership. But how do you effectively build and understand business value now? Taking strategic steps today lays the foundation for a prosperous future, ensuring that your business remains a valuable investment over time.

Business Valuation

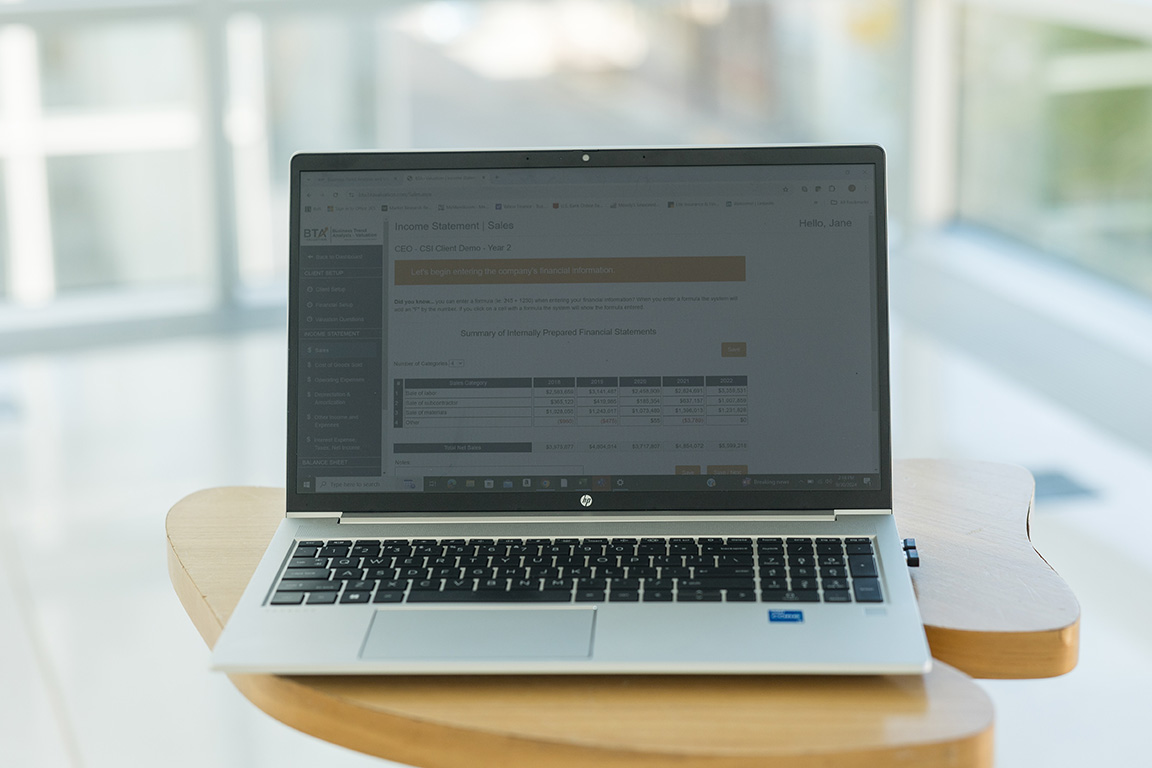

We help privately held business owners learn to think of their business as an investment they can proactively manage over time, including working through the tough questions that come with each stage, to ultimately reach their goals.

Exit Planning

Gift and Estate Tax Compliance

Understanding

& Driving Value

Buy-Sell Agreements

Attorney Solutions

Since 1974, Capital Valuation Group has been a trusted partner for law firms across the Midwest and the U.S., offering unparalleled consulting and business valuation services. Our independent firm excels in providing strategic insights, with a proven track record of defending analysis before tax authorities and in both state and federal courts.

Attorney Solutions

Since 1974, Capital Valuation Group has been a trusted partner for law firms across the Midwest and the U.S., offering unparalleled consulting and business valuation services. Our independent firm excels in providing strategic insights, with a proven track record of defending analysis before tax authorities and in both state and federal courts.

Gift and Estate Tax Compliance

Litigation

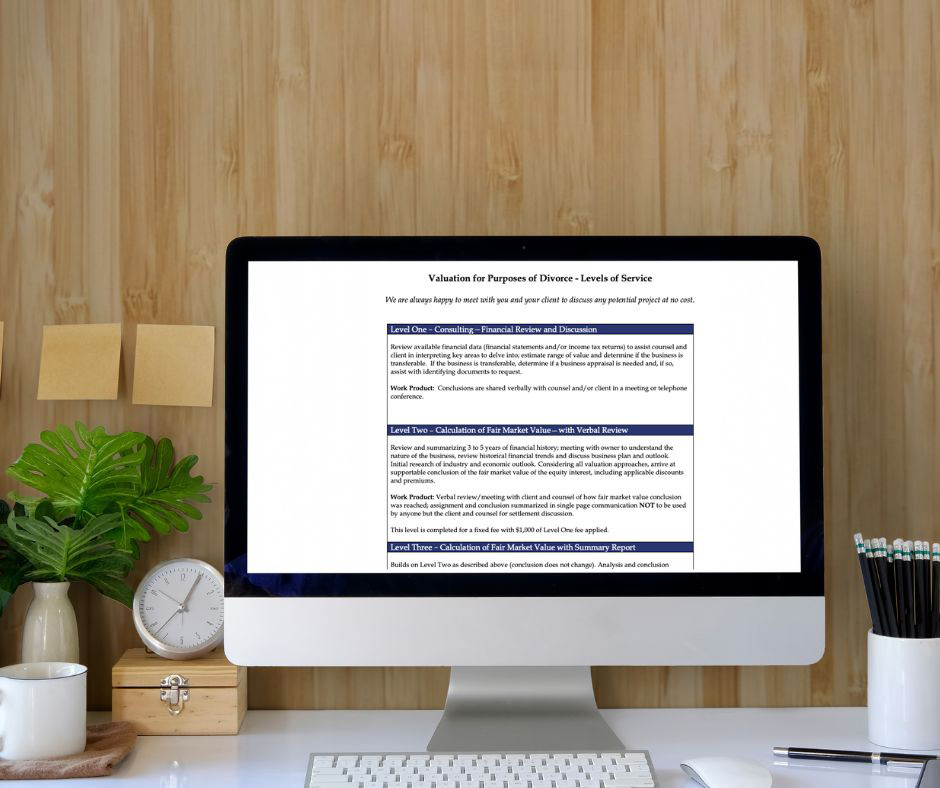

Family Law

Mergers & Acquisitions

Other Advisors

Unlock new growth opportunities and enhance your current offerings with our collaborative business valuation approach. By working hand-in-hand with you and your clients, we can identify gaps and uncover paths to success, transforming financial complexities into actionable strategies.

Let’s work together to seamlessly integrate business valuation into your practice, ensuring your clients achieve their goals with confidence. Engage with us today and experience the power of partnership-driven success.

CPAs

Wealth Advisors

Banks/Bankers

Business Brokers

Meet Capital Valuation Group

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Meet Capital Valuation Group

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Jane M. Tereba, ASA, CPA, CEPA

President

Martin P. Mathias, CPA, CFE

Vice President

David M. Mitten, MBA

Vice President

Jane M. Tereba, ASA, CPA, CEPA

President

Martin P. Mathias, CPA, CFE

Vice President

David M. Mitten, MBA

Vice President

Learn What Matters Most with Business Valuation

Our Introduction to Business Valuation 22-page guide breaks down complex valuation concepts and highlights key drivers of value. We wrote it to serve as your go-to reference for business valuation basics.

Valuation Analysts & Brokers: Two Different Approaches to Answer “How Much is my Business Worth?”

Jane Tereba | September 25, 2025 For years, Cap Val has been vocal about the shortcomings of simple "earnings x a multiple" valuations. We've written - and advised clients - around the conviction that a business's true worth can't be reduced to a market multiple applied to last year's earnings. I still believe that. ...

The Story Behind the Numbers

Valuation Analysts & Brokers: Two Different Approaches to Answer “How Much is my Business Worth?”

Jane Tereba | September 25, 2025 For years, Cap Val has been vocal about the shortcomings of simple "earnings x a multiple" valuations. We've written - and advised clients - around the conviction that a business's true worth can't be reduced to a market multiple applied to last year's earnings. I still believe that. ...

Why Every Business Owner Needs Regular Valuations (Not Just for Exit Planning)

Jane Tereba | August 21, 2025 Most business owners think of valuation as something you do when you're ready to sell. It's the final step, the...

New Tax Bill Brings Major Changes and Planning Opportunities for Business Owners

Martin Mathias | July 24, 2025 The recently passed tax legislation, the "One Big Beautiful Bill," delivers significant benefits for...

Planning a Family Business Transition? Start with Financial Clarity and Transparency

Jane Tereba | June 19, 2025 Family businesses are often the culmination of years of hard work, legacy, and dedication. However, transitioning...

Tariffs and Debt: Valuing Your Business in Uncertain Times

Jane Tereba | May 22, 2025 At recent networking events, every conversation I have had has revolved around the same question: How does today's...